The Best Education Investments for Your Child

If you’ve recently had a child – or are planning on becoming a parent – you’ve probably already thought about putting some money aside for their education. And if you haven’t, you should, because it pays to start putting money away as soon as possible, so you can get the most benefit from stock market growth, compound interest, and tax incentives.

There are many ways to save for your child’s education, ranging from government-sponsored savings schemes to long-term investments in the stock market. In this article, we’ll take you through the best of these.

1. Open a 529 Plan

For most people, the best place to start saving money for your child’s educational future is a 529 plan. 529 plans are savings plans sponsored by state governments, and they often allow you to deduct your contributions from your state taxes. That makes them a tax-efficient way to regularly save for college fees.

It’s also important to note that you can open an account in any state – not just the one you live in. So if you see a 529 plan that you like anywhere in the US, don’t hesitate. The earlier you start a 529, the more chance it will have to grow.

2. Education Plans in UAE and GCC

Now moving to the UAE, there are similar plans that can assist in saving for an education plan for a child. We’re talking about Professional Education Plan, Regular Income Plan, and International Investor Advantage.

The Professional Education Plan is ideal for parents who are looking to invest in plans with no capital risk and assured returns. This plan provides guarantee of both capital and returns on maturity.

Comparatively, the Regular Income Plan is perfect for parents looking for an investment with a capital guarantee but are seeking higher returns.

It is a combination of multiple Endowment plans aligned with the potential fee payment schedule of the child, providing higher returns than the professional education plan. Even though this plan is not guaranteed, the bonus has been consistently increasing since 1990.

Lastly, the International Investor Advantage is a short term investment plan with long term growth opportunities. It is the best option for expat parents wanting to save aggressively over a short period of time.

Unlike the other plans, this one helps you make your money work harder. It provides access to more than 170 direct funds helping you build a robust portfolio of low-cost index & mutual funds depending on your investment goals. But, one thing to take into consideration is that there is no guarantee of capital and returns in the investor advantage plan.

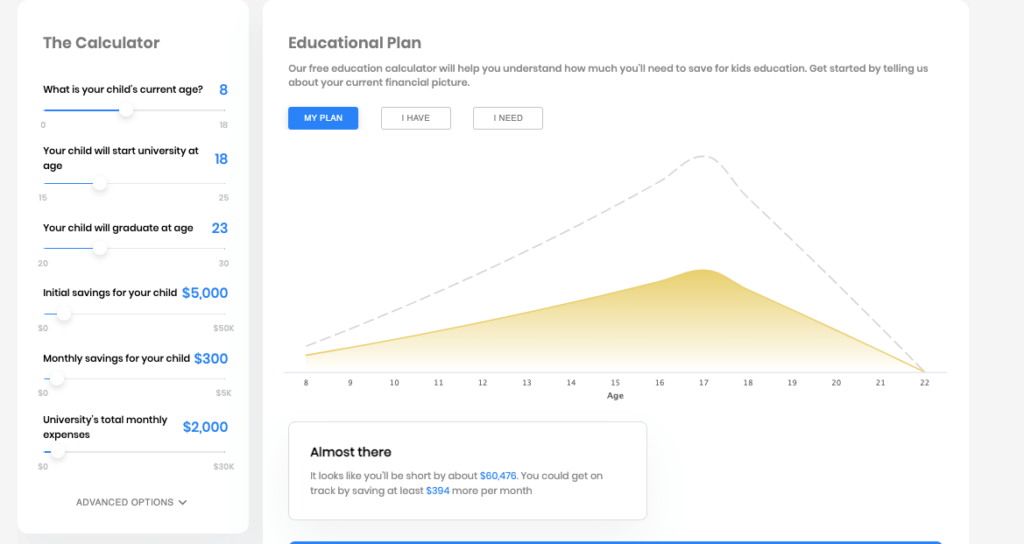

One remarkable education plan is that offered by Wealthface in the U.S, UAE and GCC countries. Starting from a small amount of money, you can access a free education calculator that will help you understand how much you’ll need to save for kids’ education.

3. Savings Bonds

Savings bonds are another popular way to save for a child’s education. These are bonds which are guaranteed by the government, and are therefore low risk. Even better, when you take money out of a savings bond, you can exclude this from your tax return as long as you are using it to pay for higher education.

The disadvantage of a savings bond – in comparison to investing in shares, for example – is that they generally come with very low interest rates. Right now, individual Series EE savings bonds are earning an annual fixed rate of 0.10%. In other words, investing in bonds generates a fixed income, that’s why it’s better to invest in an ETF’s portfolio to make higher returns.

4. Coverdell Education Savings Account

A Coverdell education savings account is a trust account that is focused on saving for higher education. Money you put into this type of account is tax-free, and as long as you use it to pay for education when you take it out, it’s tax-free then as well.

The only drawback here is that all the funds in this type of account must be used by the time your child is 30, so if they go on to postgraduate study you may need to use other sources to fund their ongoing education.

In the UAE and other GCC countries, an education saving account can be offered by banks providing education plans. However, due to account minimum request, high transfer fees and commissions, saving accounts at banks cannot be affordable.

On the other hand, it is preferred to have an education saving account for your children in one of the trusted wealth management companies. It is significant that Wealthface offers a savings account to help you afford the education of your children.

Unlike banks, Wealthface makes investing in an education account available at the lowest costs starting from 1$ without any wire or transfer fees. You can create a savings account and start investing in your children’s education plan.

5. ETFs and Mutual Funds

If you are looking for a relatively safe return on the money you are investing for your child’s future, look to mutual funds or well diversified share portfolios. The downside here is that you will have to pay tax on your returns, but the upside is that you can tailor your portfolio to be exactly how you want it.

This is where Wealthface comes in. Our platform allows parents to build share portfolios that strike a balance between risk and reward, and put aside money for their child’s education. Even if you’ve never invested in shares before, you’ll find our approach easy to understand and use.

6. Permanent Life Insurance Policies

Permanent Life Insurance policies are used by high net worth families to put aside money for their children after their tax-free options reach their maximum permitted levels. This type of life insurance splits your contributions – some goes towards the death benefit, but some goes into a tax-deferred savings account.

You can use that savings account for any purpose, and it can be accessed at any time. This makes it a good source of funds for tuition fees, or any other large expense in your child’s future.

Insurance companies let you have insurance protection with an investment plan option. However, the investment plan option has so many limitations:

- The client can not withdraw the money whenever he wants, and if he does he will be deducted 20% per year before the end period.

- No flexibility: in case you decided to stop paying for an insurance plan, you will lose all the money paid already

- You can not change the payment plan or the amount paid monthly.

- High fees: The fees are 3% to 4% per year

Regarding all the disadvantages mentioned above, the best way is to invest in a diversified portfolio of ETFS with a company that makes sure to have the know-how to protect your money and optimize your return in the long-term.

One of the companies that can protect your investments is Wealthface. You can invest in a diversified portfolio of ETFs and receive maximum returns with minimum risk.

Check Wealthface invest: Wealthface Invest

7. Home Equity Loans

A more unusual approach is to take out a second mortgage on the equity tied up in your home. Some families will prioritize paying down their mortgage before their kids reach college age, and then take some of the equity as a way to fund them through college.

Others, having not been able to save enough before their child reaches college age, turn to this option as a last resort. Though this method can work, it’s not the best one to use. It’s difficult to predict the value of your equity 15 years from now, and it puts your house at risk.

Instead, parents nowadays have a huge opportunity to start investing in an education plan for each child separately, even if you are only saving a little amount each month.

This is an efficient strategy to guarantee education for your children without burden. Imagine investing $394 in an education plan for your 8 years old child, and receiving a compounded return of 4% per year. After 10 years, you’ll have $114616, then your kid will be able to pay for his intuitions and expenses.

This is the right way to do things instead of taking a loan on your house, and ending up under a debt to the bank. On the contrary, investing in an education plan will provide education for your children and keep the family house protected at the same time.

Check the education plan at Wealthface: Education Calculator

The Bottom Line

Research indicates that education is one of the best investments you can make for your future. Though college in the USA is very expensive, by getting a degree your child will have access to much higher lifetime earnings, more than making up for this expense.

Just make sure you start planning – and saving – early, to give your child the best possible future.