5 Tips on When to Sell Your Stocks

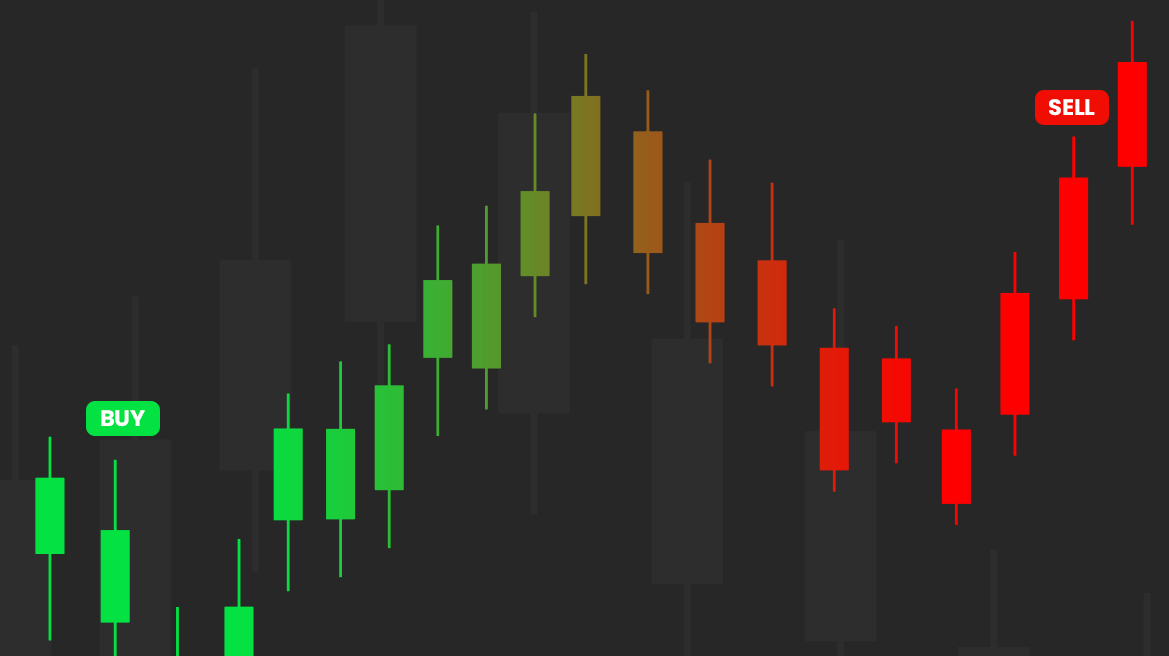

How many times have you bought a stock on someone else’s recommendation? How many times, instead of making a quick buck, you had to wait for months, maybe years, just to recover your cost? Do you know the correct time to sell your stocks and exit the market? Well, even though it may seem easy to enter the markets, it is difficult to leave its pull, thereby making it a risky affair.

Buy recommendations are very prevalent and keep on stemming from a wide range of sources like investment newsletters, analysts, stockbrokers, and investment managers. However, there are very few sources to advise on when it is best to sell a stock. For making wealth in stock markets, it is very crucial to know when to sell the stocks. The investor should not end up selling stocks early making him lose easy-coming wealth. At the same time, the investor should not hold a stock for a long time in a deteriorating business situation. Therefore, deciding when to sell the stocks becomes a trickier decision than buying them.

Warren Buffett, in his 2014 letter, advised the investors’ community stating, “Since I know of no way to reliably predict market movements, I recommend that you purchase Berkshire shares only if you expect to hold them for at least five years. Those who seek short-term profits should look elsewhere. For the great majority of investors, however, who can – and should – invest with a multi-decade horizon, quotational declines are unimportant.”

Holding a stock for a long time is essential. However, as an investor, we need to make sure that these stocks are carefully handpicked. Therefore, monitoring the stocks in the portfolio and taking appropriate selling decisions becomes very essential.

In this article, we will be helping our readers with five tips to make a better decision concerning when to sell their stocks.

1. Always set a target price

Generally, while buying a stock, investors should establish a price target or at least a range in which they would consider selling the stock. This helps them to make understandable decisions and avoid being a trap of greed. This stock purchase should be a result of a careful fundamental and technical analysis from the side of the investor. Choose the target price carefully because even for most seasoned investors, this decision often becomes a problematic one. This price must be kept more on realistic terms, to lock in gains.

2. Look out for significant business changes

All the investors must track the changes in their chosen stock regularly. An investor must have a good understanding of a company’s main attributes, competitive landscape and industry, environmental changes, societal trends, economic conditions, and the financial outlook. Initially, it may be a little difficult to make decisions based on these understandings, but in the due course, investors will be able to make a spot-on decision using this information.

3. Rebalance your portfolio regularly

Several companies are competing with each other in the same industry. Not every company performs well all the time in every business scenario. Therefore, along with portfolio diversification, it becomes extremely important for an investor to rebalance their portfolio. Such rebalancing will help investors to sell their stocks at the right moment and the right price.

Rebalancing of a portfolio is also advantageous in business scenarios where a particular market is not performing well. For example, a trend has been noticed over time that whenever there has been a stock market crash, the gold market rises manifold. So, as a regular investor, in such situations, it will be very much profitable for him/her to exit from the stock market and invest his money and gains in the gold market to earn even more returns on their wealth.

4. After a merger

Generally, as per theory, the average takeover premium, or price at which a company is bought, ranges between 20-40%. Therefore, as an investor, it becomes crucial to take hold of different mergers and acquisitions taking place in the market because, if you will be owing to a stock in that, you will end up selling your stock for a significant premium.

Mergers come with other benefits too. If the competitive position of the combined companies has improved substantially, it will be beneficial for you. However, history shows that mergers have a lousy track record of being successful, and it can take many months for a deal to close. This sometimes makes investors lose on opportunity cost benefits.

5. Understand that your money holds a greater value elsewhere

Why do people invest money? Well, to build wealth for themselves and their families and to have a secured future. Whether it is buying your first car or saving for your retirement, there will always come a point, when the money you’re currently holding in stock needs to be used elsewhere. In such a case, selling your stock to convert those assets into cash might be a necessary decision if your money holds greater value somewhere else in your life.

Conclusion

Selling decisions is indeed a combination of both art and science. With several considerations to make, such as those above, we hope that some of our tips could prove to be worthy for your portfolio. Easy said, “Buy low, sell high”, actually becomes a challenging strategy when it comes along with so many other decisions to be made.

Therefore, we always advise our readers to do their research, trust their calculations and instincts and not fall in the honey traps laid by several third-party sources.

Happy Investing!!