Halal investing

Invest with Mahfaza

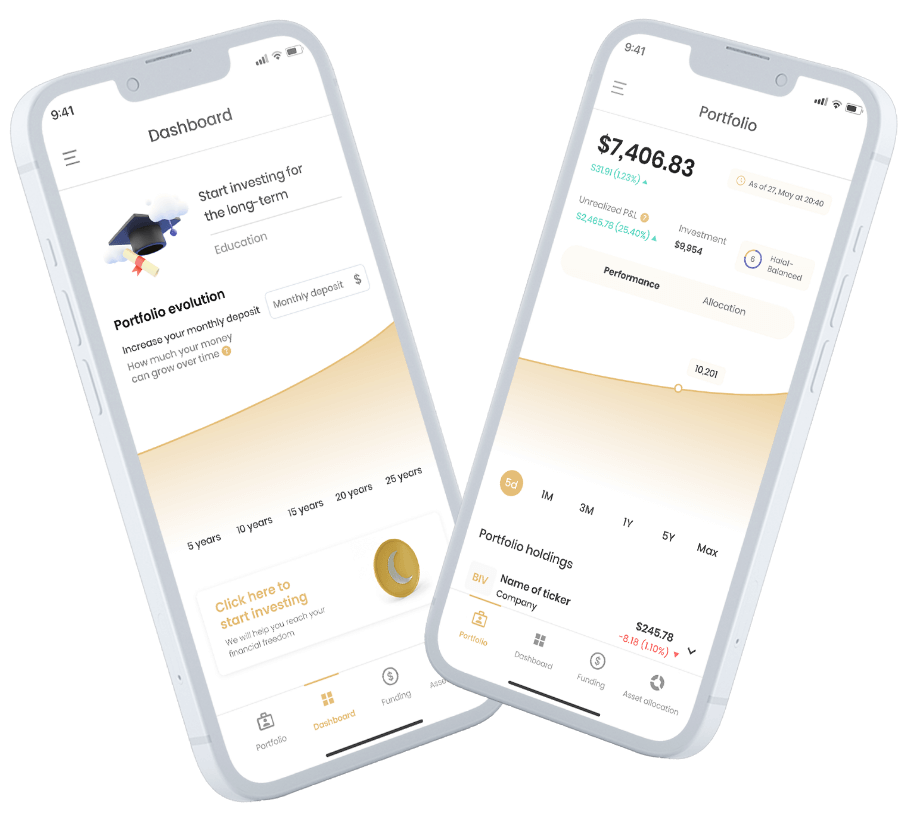

Build wealth with your Smart Halal Investment Portfolio

Backed by an Award Winning research

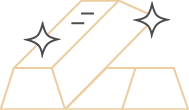

Invest in a diversified Halal portfolio

We automatically invest your money in a Halal diversified investment Portfolio based on your beliefs, so you can now start your investment journey without compromising your values.

Your Mahfaza is invested in diversified Halal ETFs

Keeping a portion of your portfolio in Cash is always good to keep as an emergency fund when it is needed.

Shariah ETF that provides exposure to the Shariah-compliant real estate asset class through REITs which meets Shariah screening requirements, including compliant business activities, lower debt levels, and permissible income within acceptable levels.

A sukuk is an islamic certificate, similar to a bond in Western finance, that complies with Islamic religious law commonly known as Shariah.

Gold has been a special and valuable commodity.

Owning gold can act as a hedge against inflation and deflation alike, as well as a good portfolio diversifier. Gold is a good investment since it always maintains its value over the long term.

Our Mahfaza Investing Principles

Your Investment portfolio is invested in equities and cash.

- We do not invest in companies that generate significant revenues from interest.

- We do not invest in companies that profit from alcohol, gambling, pork, financial services, or weapons.

- We do not invest in bonds, which are prohibited in Islamic law since they pay interest.

- We manage our client’s risk appetite by balancing between equity and cash.

The next generation of Halal trading

- Access Shariah Compliant ETFs & Halal stocks

- Select Halal Large-cap VM portfolio

- Select your Halal Large-cap low volatility portfolio

- Select your Halal multifactor portfolio

- Access to ETF Sukuk that complies with the Shariah law

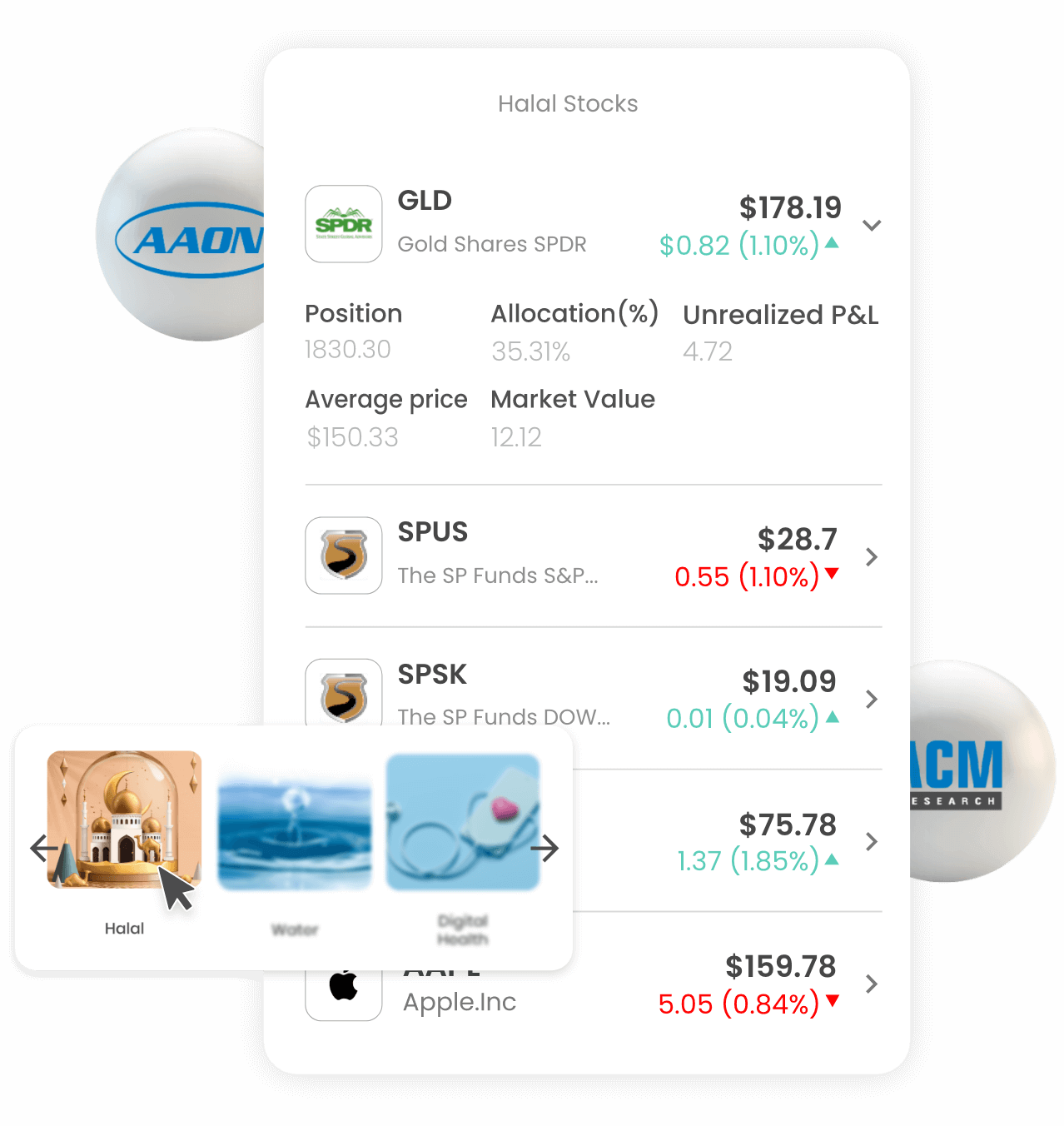

Enjoy free local transfer

Wealthface offers smoother investing, allowing instant free transfers in USD without any wire transfer charges or any transfer fees. We care about every penny!

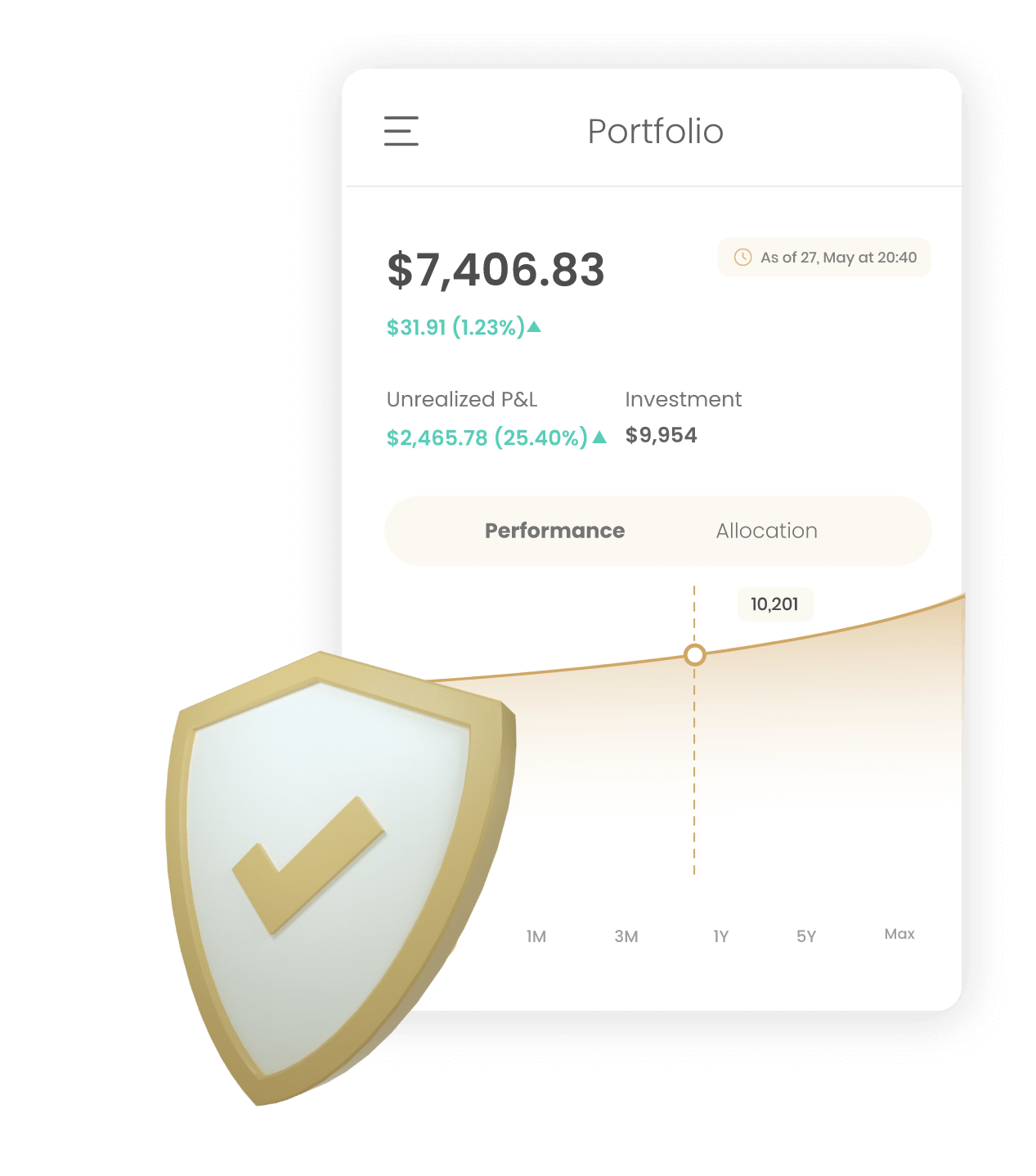

Your Money is safe and secure

Pricing and Benefits

You don’t need to pay a lot to grow your money, you simply need smart solutions tailored in simple ways.

Basic

Deposit $0 - 100k

- Pay management fee

- Customized portfolio

- Fractional investing

- Auto-rebalancing

- Expert financial advice

- Tax efficiency

- Free portfolio check-up

- Dividend reinvestment

- 0.2% MER fees

Platinum

Deposit $100k - 500k

- All Basic plan features

- Reduce management fee

- Financial planning sessions (once per annum)

- Systematic portfolio monitoring

Infinite

Deposit $500k+

- All Platinum features

- Reduce management fee

- Full financial planning review in-depth

- Dedicated financial advisor assigned

Start investing with a ClickAway