Start online trading with just $1

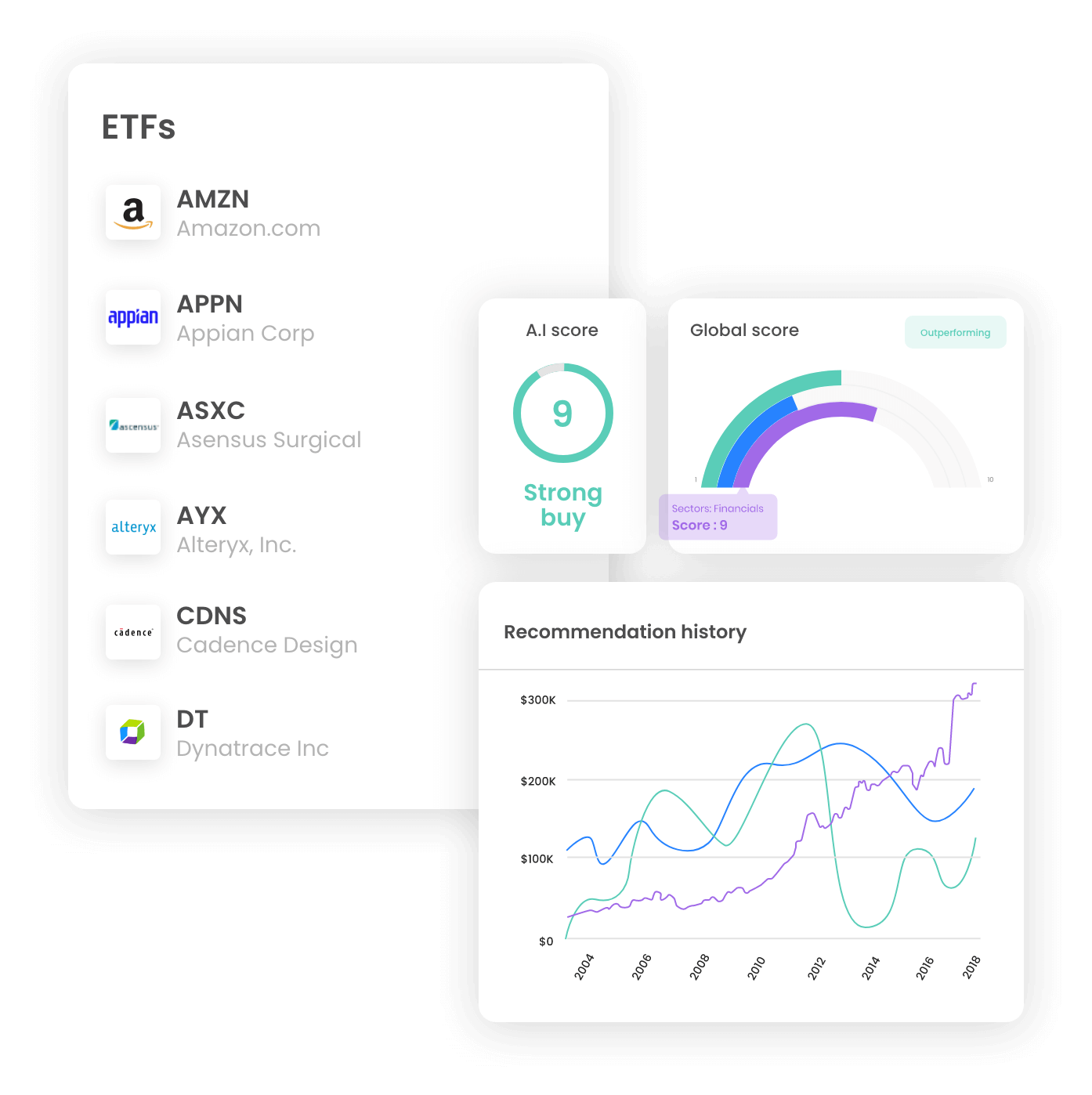

Trade in 8500+ Global Stocks & ETFs

- Buy and sell 8500+ of stocks and exchange-traded funds (ETFs) on major U.S. exchanges

- Build your basket of stocks for free

- Rebalance your basket free of charge

- Access comprehensive stock screening tools

Trade at low cost, with only $1

- No account opening fees

- No account minimum; Means you can get started with as little as $1!

- 0% stock trading. Sell stocks for free. Pay $0.01 per share for buy orders

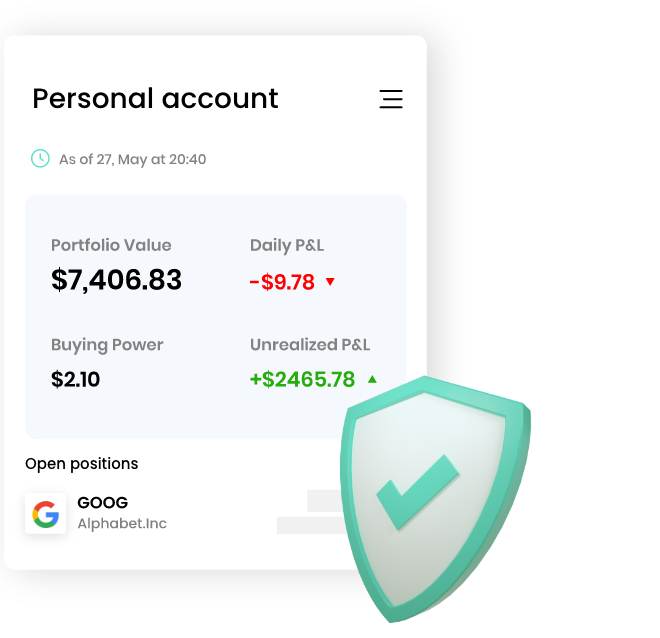

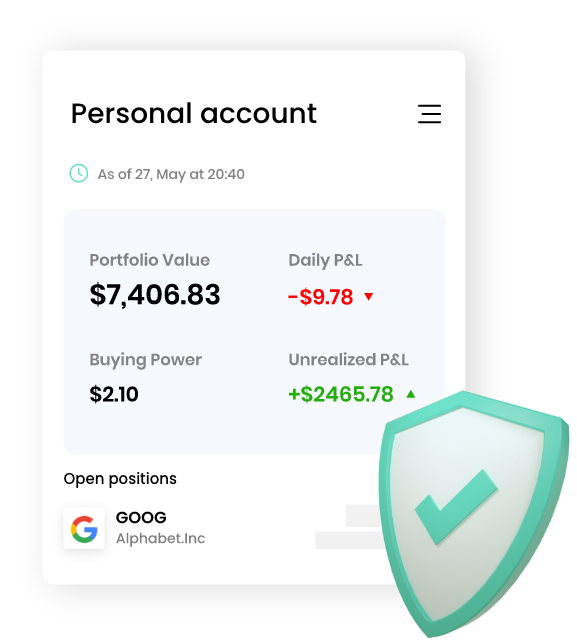

Online trading made Easy & Safe

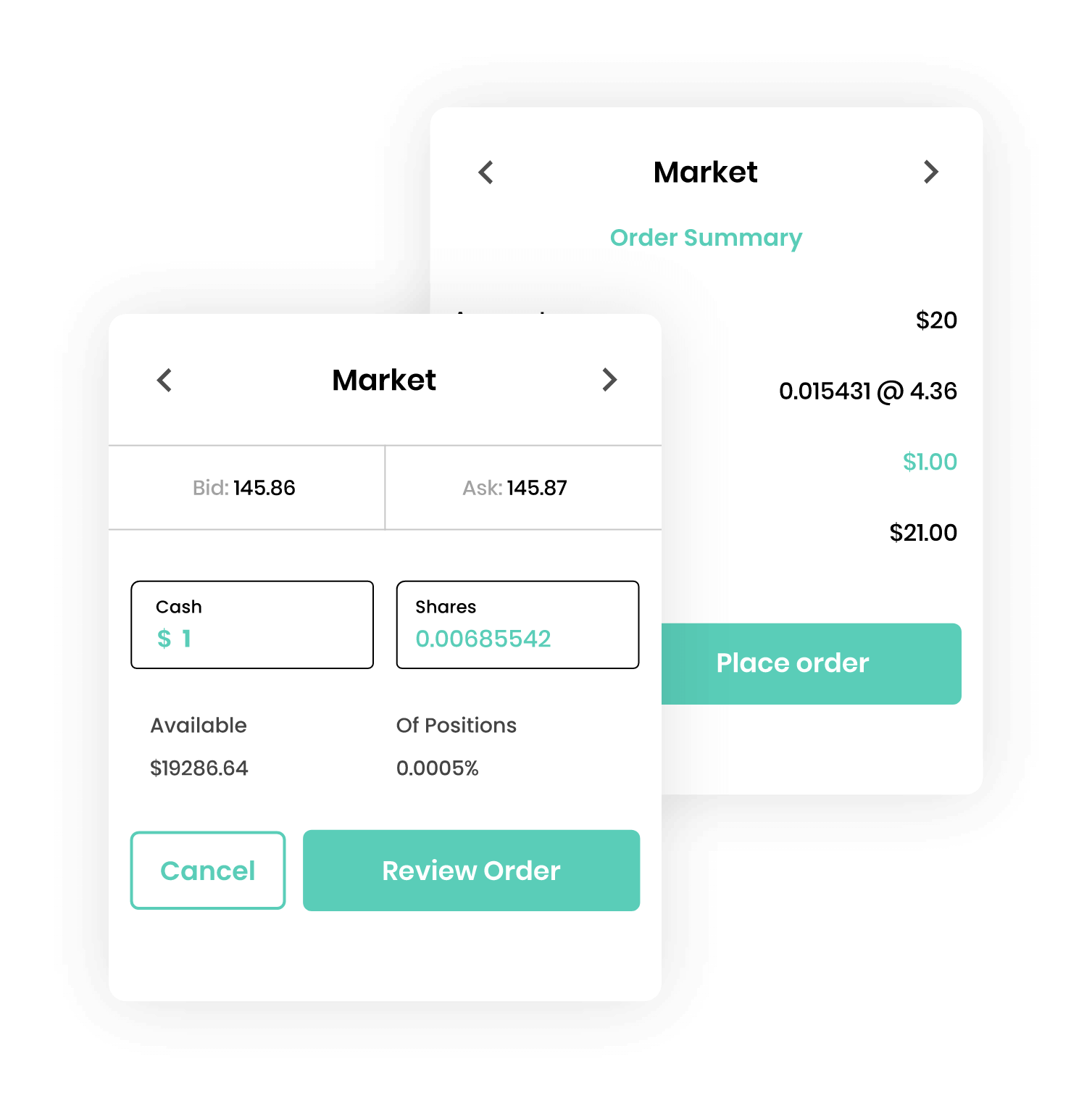

Introducing fractional shares

Buy thousands of stocks for as little as $1!

- Invest a small amount

- Build your portfolio

- Trade in real time

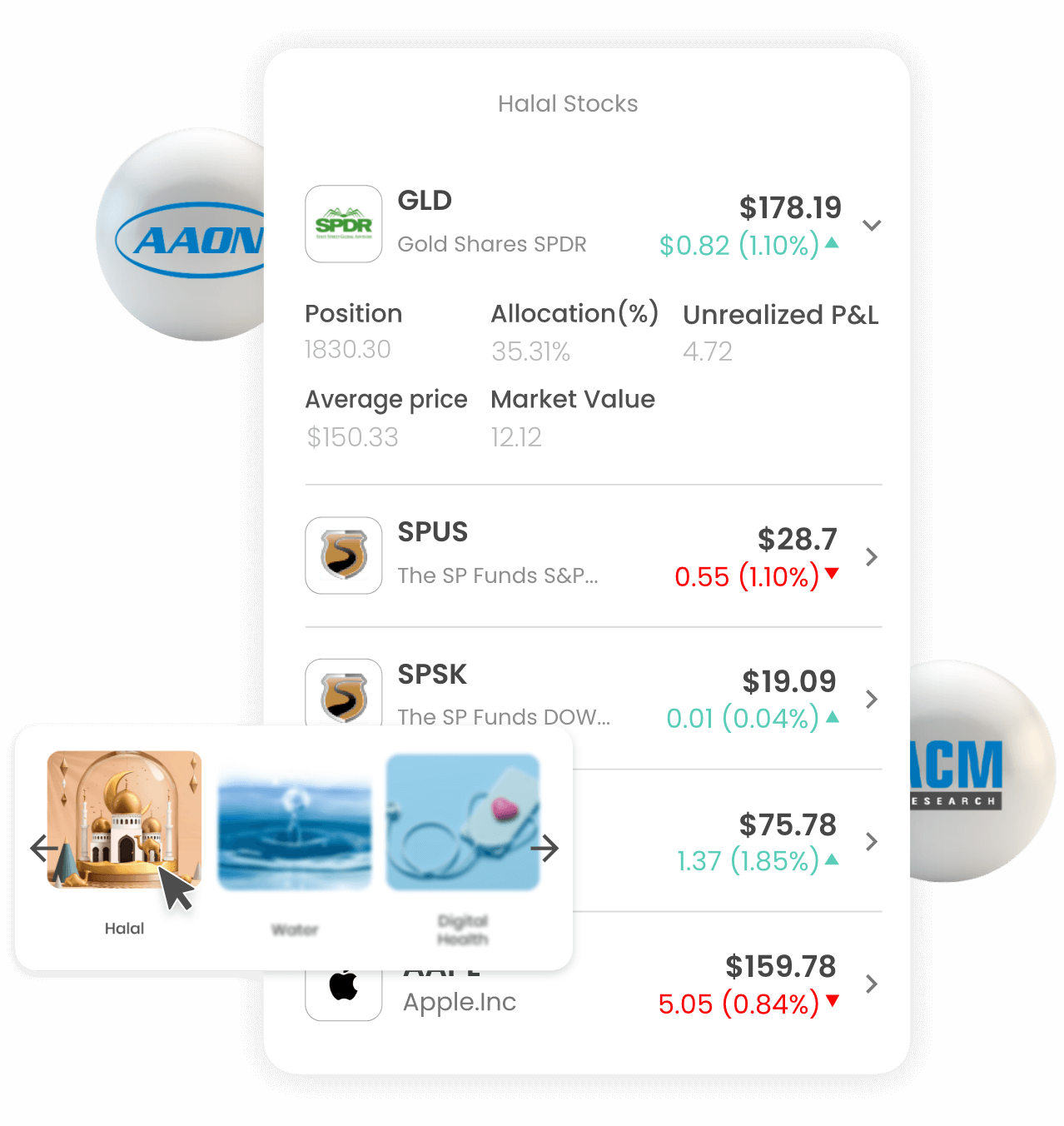

Access Halal Stocks & ETFs

- Select your Halal multifactor portfolio

- Select Halal Large-cap VM portfolio

- Trade Halal stocks & Shariah Compliant ETFs

- Select your Halal Large-cap low volatility portfolio

- Access to ETF Sukuk that complies with the Shariah law

Benefits and pricing

Buy and sell thousands of stocks and ETFs

- Pay a maximum of $1 per transaction or per share.

- Start trading stocks for as little as $1.

- Benefit from multiple order types: market, limit, and stop.

- Receive live market data for stocks.

- Get access to our diverse themes list.

- Build and rebalance your own portfolio.

- Benefit from monthly admin fees as low as $2.

- Enjoy free local transfers if you’re in the UAE.

- Sell stocks for free.

- Pay per share for buy and sell orders.

- Start trading stocks for as little as $1.

- Benefit from multiple order types: market, limit, and stop.

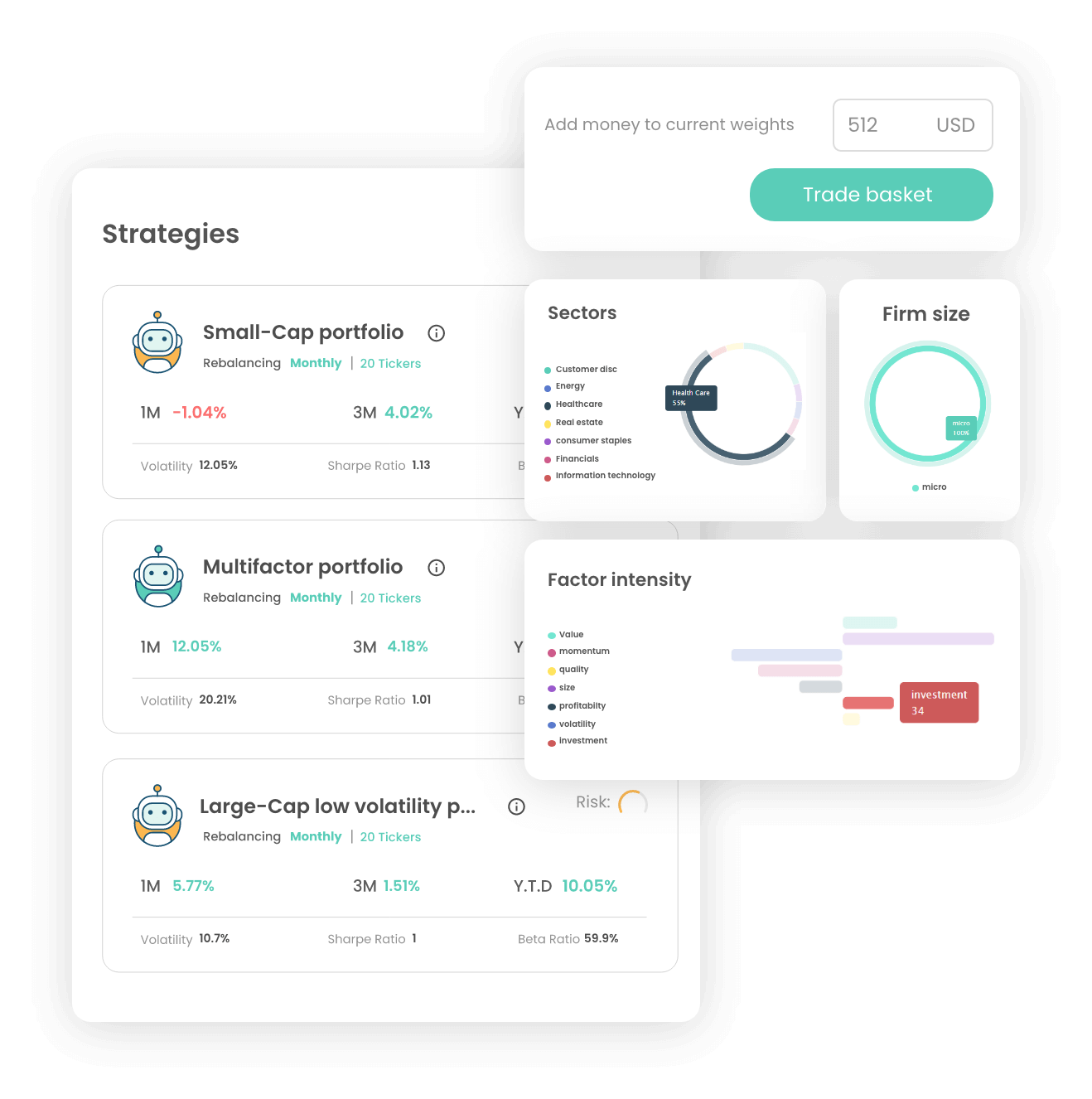

- Access our collection of quantitative investment strategies.

- Receive live market data for stocks.

- Get access to our diverse themes list.

- Build and rebalance your own portfolio.

- Access quantitative stocks analysis.

- Benefit from no monthly admin fees.

- Enjoy free local transfers if you’re in the UAE.

Open an online trading account in just 3 simple steps

-

What is Wealthface?

Wealthface is a UAE-based one stop-shop online investment solution on a mission to make investing accessible to everyone everywhere using a Cutting-edge technology and smart investment solutions.

-

What are the multiple account types on Wealthface?

There are currently 3 types of accounts on Wealthface.

The free general investment account where you can access a list of portfolios of ETFs on the US exchanges. You will have your investment portfolio based on your risk profile and we will rebalance it for you on a quarterly basis free of charges, no hidden fees and no trading fees.

You can also have a trade account which will cost you only $2 per month.

The low-cost trade account provides you with all tools you need to invest-from 6000+ US stocks and exchange traded funds, build your own basket and watchlist views, and access for a free newsletter on the latest updates on the market and insights. You can elect to advance the premium of factor investing backed by a Nobel prize award winning research of multiple factors, which will let you build your own factor-based portfolios with a Halal Islamic option of multiple stocks.

-

Is Wealthface Trade app free to use?

The Wealthface application is free to download. With Wealthface, you can invest in 6000+ stocks and exchange traded funds (ETFs) at a low cost, $1 per trade, meaning no other charges when you buy and sell stocks on Wealthface, no spread, no slippage and no overnight interest, zero interest free of charges. Wealthface does not have any funding fees, withdrawal fees, any asset holding charges, only a small management fee of $2 per month where you can have access to unlimited account statements monthly free of charge.

-

What are the charges for a Wealtface account statement?

Wealthface offers you a free account monthly statement. Zero fees, free of charges.

-

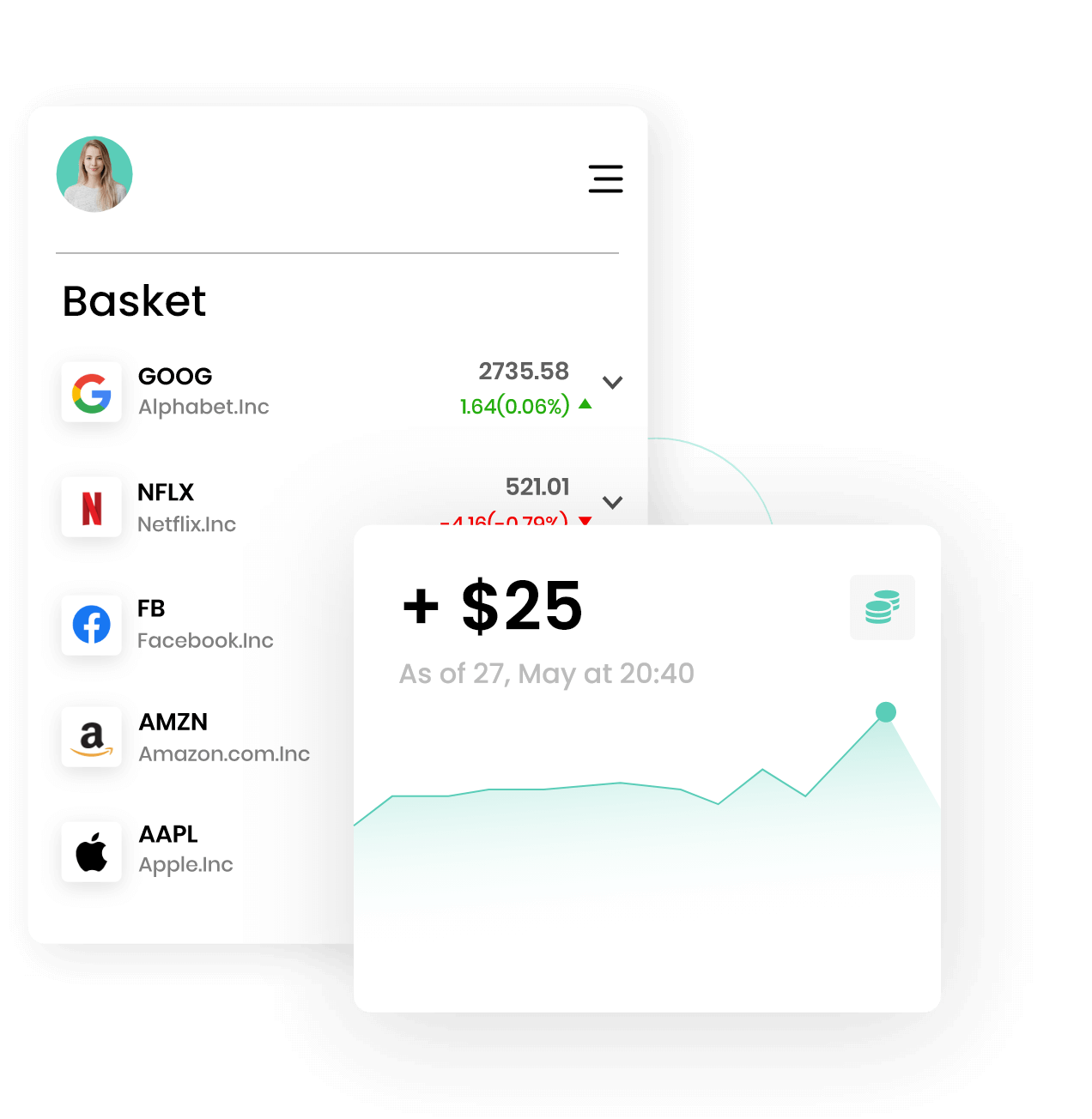

What is a Wealthface trade basket?

A basket is a free tool, where you can build your own portfolio of stocks, rebalance your portfolio based on your target that you decide and weights of allocations that you choose for each stock in this basket.

You can have a basket of one single stock or multiple stocks of your choice.

-

How is Wealthface able to offer a free basket?

Wealthface isn’t your stock brokerage. We are the first and only technology company that offers a full basket to their clients. We are a Fintech company with a hybrid solution where we offer the best of the words digital and human combination with an agile technology approach.

Wealthface is the only trade platform in the Middle East to give you the possibility to build your basket of stocks, rebalance it anytime you think it is the right time with a fully automated investment solution using superior and advanced cutting-edge technology with a superior investing user experience.

-

How does Wealthface make money?

Wealthface trade is the first application in the middle east that offers a full user experience investment journey from buying, selling or holding stocks to building your own basket, rebalancing it and modifying it, and editing it the number of times you like.

Wealthface trade only charges are the maximum between $1 per trade or $0.03 per share.

For example:

- ● If a transaction was for 53.5 shares, then the Share Charges assessed to the account for such a transaction would be calculated as follows: 53.5 shares are rounded to 54 shares and assessed a charge of $0.03 * 54 shares = $1.62.

- ● If a transaction was for 10 shares, then the Share Charges assessed to the account for such a transaction would be calculated as follows: the maximum of $0.03 * 10 shares and $1 = $1

-

Where does Wealthface operate?

Wealthface operates in the United Arab Emirates, but we are accessible to everyone everywhere. We are MAINLY focused on users in the GCC and the United States.

Our factor investing products are accessible to everyone everywhere to build a global stocks portfolio on different stock exchanges: USA, KSA, UAE, UK and Canada.

-

What is the minimum withdrawal amount?

There is no minimum withdrawal amount from your account. You can withdraw whatever you find suitable for your needs anytime.

You can withdraw the money directly from our brokerage partner or directly from your Wealthface account.

Take note if you withdraw your money from the broker partner dashboard account there is a charge, Wealthface has nothing to do with these charges and do not take money on this transaction.

You can access the withdraw option from our dashboard when you access your account. You can select the withdrawal option and enter your bank details swift, IBAN, and full address.

-

What are the withdrawal fees?

There are two ways to withdraw your money.

The local withdrawal transfer option:

The local transfer: We do not charge any withdrawal fees. This option will be available soon, this way you can get access to your funds whenever you need them, without delays or restrictions.

The international transfer option:

Wealthface does not charge any fees. The broker will charge up to $30 for each transaction.

To withdraw money from your Wealthface invest account, follow the steps below:

- ● Access to your dashboard section on the Wealthface app

- ● Select the withdrawal option on the right side of the screen

- ● Enter your preferred withdrawal option

- ● Enter your preferred withdrawal amount

- ● Choose your preferred bank account

- ● Enter your swift code, IBAN and full address

Please note third party transfer is prohibited and only bank transfer to the personal user account is allowed.

-

Can I use multiple different banks to fund my Wealthface account?

Yes, you can use multiple bank accounts with the currency of your choice to fund your account. Wealthface does not make money on the exchange rate and there are no restrictions on the accepted currencies.

For example:

If your account is in AED and you want to fund your account with AED 15,000, you will receive your money in your Wealthface account in 4084 USD. Formula (15000/3.6725= USD 4084) If your account is in Saudi Riyal, the same process applies depending on the bank exchange rate.

-

What are the options to fund my Wealthface account?

To fund your investment account on Wealthface, we have provided you with multiple options:

- ● Local AED free transfer

- ● International wire transfer

- ● Transferwize

- ● Credit card (Visa, Mastercard and American express)

- ● SEPA

- ● Others

The information you need to enter to add funds for the international wire transfer only:The information you need to enter to add funds for the international wire transfer only:

- ● Bank Name

- ● Swift code

- ● Aba#

- ● Bank Address

- ● Beneficiary Name

- ● Beneficiary Account Number

- ● Beneficiary Address

- ● Wealthface Account Number

This information is needed when you do the transfer from your own bank account.

Please note for US clients, you can fund your account instantly by connecting your bank account through plaid and fund your account immediately from your personal account dashboard.

-

How can I close my account?

If you would like to close your account, please email us at support@wealthface.com

Account Management

You can change your password if you follow the steps below:

- ● Login to your account dashboard

- ● Select Account Details

- ● Select settings option

- ● Privacy & Security

- ● Enter your new password

- ● Update the password

-

How can I recover my password?

If you forget your password, all what you have to do is to follow the steps below:

- ● On the login or sign-up screen

- ● Choose the login option

- ● Click on forgot password

- ● Enter your registered email

- ● Click on Reset password bottom

- ● You will receive an email

- ● Enter your new password and update it

Account Opening

What ID documents are accepted on Wealthface?

If you are in the Gulf Cooperation Council (GCC) you have to upload your passport copy as an official document and accept it to open an account.

If you are a US resident, you do not have to upload an ID document, all you have to do is enter your Social Security Number.

What Proof of address documents are accepted on Wealthface?

An accepted proof of address for users in the Gulf Cooperation Council

(GCC) can be either:

- ● A bill from the relevant water and electricity authority (DEWA, SEWA. or FEWA, for instance)

- ● A tenancy agreement (Ejari contract for UAE residents)

- ● A telephone bill

- ● A bank statement.

If you are a US resident, you do not have to upload any proof of address document.

-

How much time does it take my funds to be received in my Wealthface account?

If you use the international wire transfer to fund your Wealthface account, Bank transfers can take 2 to 3 business working days.

Please note that an international bank transfer is processed only during normal banking hours from Monday to Friday. An example: if you make your transfer on Friday night, you should start counting from Monday morning and you will receive your account only by Wednesday or Thursday.

If you use the local transfer, the same process as above. Wealthface technology team is working to offer you an instant funding option soon if you use your local transfer option. We will update you once this feature is available.

Please note our US residents, your funds will be received immediately in the Wealthface account when they deposit their money.

-

Who can open a Wealthface investment account?

The minimum age to have an account with Wealthface is 18 years.

-

Where Wealthface is available in which countries?

Wealthface is available to residents of all countries within the Gulf Cooperation Council (United Arab Emirates, Oman, Bahrain, Saudi Arabia and Kuwait) and also available for the residents in the United States of America.

-

How much do I need to start trading with Wealthface?

You can start trading on Wealthface with as little as $1. There is no minimum deposit.

-

How do I register/Sign up to Wealthface?

You can register to Wealthface on the link below: www.wealthface.com

At Wealthface, you only need to open one account and you can access an investment or trade account.

Because we care about you, we will ask you some questions related to your risk profile to make sure we can advise you better.

Please note that you have the freedom to let us manage your money or you can trade on your own the stocks of your choice.

- ● Sign up

- ● Complete your risk profile (KYC)

- ● Personal Details: Complete your personal information.

- ● Validate your identity: Verify your identity by submitting a few documents and a proof of address.

- ● For document verification, you will either require your passport, identity card.

- ● A proof of address can be either a bill from the relevant water and electricity authority (DEWA, SEWA, FEWA, for instance), a tenancy agreement (Ejari contract) for UAE residents only, a telephone bill or a bank statement.

Once you are done and your account is approved:

You can now download the application from the Google Play Store or the Apple App Store. Now you can login and start your investing journey.

Please note we have two app, Wealthface invest for discretionary service and Wealthface trade for non-discretionary service and trading.

-

What are examples of Good faith violation?

Example 1: Cash available to trade = $0.00

- On Monday morning, a customer sells Y stock netting $5,000 in cash account proceeds.

- On Monday afternoon, the customer buys X stock for $5,000.

- If the X stock is sold prior to Wednesday (settlement date of the Y sale), a good faith violation would be charged as the X stock is not considered fully paid for prior to sale.

Example 1: Cash available to trade = $0.00

- On Monday morning, a purchase was made for $5,000 of X stock.

- On Monday mid-day, the customer sells the X stock for $5,500.

- Near market close, the customer purchases $5,500 of Y stock.

- At this point no good faith violation has occurred because the customer had sufficient funds for the purchase of X.

- If Y is sold prior to being paid for (settlement) then a good faith violation will have occurred.

Example 3: insufficient cash

Answer: Cash available to trade = $10,000 minus cash credit from unsettled activity = $5,000 (proceeds from a sale of stock the prior Friday – trade settles on Tuesday)

- On Monday morning, the customer purchases $15,000 of Y stock.

- A good faith violation occurs if this customer sells the Y stock on Monday.

- The purchase is not considered fully paid for because the $5,000 proceeds are not considered sufficient funds until they are settled on Tuesday.

-

How can I login to my Wealthface account?

You can login to your Wealthface account via the web version on our website:

www.wealthface.com and select start now (Login).

or downloaded the application from the Google Play Store or the Apple App Store. In order to register, you will be required to enter your username and password and login to start trading.

-

Is Wealthface Trade available on the Apple App store?

Yes, Wealthface trade is available on the Apple App store.

-

Is Wealthface trade available on the Google Play store?

Yes, Wealthface trade is available on Google Play store.

-

How can I download the Wealthface app?

You can download Wealthface both on the Google Play Store and the Apple App Store.

- ● On the Google Play Store if you’re using an Android device

- ● On the Apple App Store if you’re using an Apple device

-

Does Wealthface offer Fractional shares?

Yes, Wealthface offers fractional shares.

Fractional shares are a fraction of a company share or a company stock.

Wealthface trade allows you to buy less than a full share of your favorite stocks. With as little as $1, you can now get a slice of your favorite compagnies in the United States like Amazon, Tesla, Microsoft, Google and Apple.

-

Why should I buy fractional shares?

The main reason you want to buy a fractional share is to gain the ability to invest in a company whose full shares are trading at a very high expensive price. If you cannot afford a single stock of Google, now with Wealthface trade you can buy a faction of Google.

Buying fractional shares is the right thing to do for new investors to get a step forward into the stock market.

-

What are the Buy/Sell order types on Wealthface?

Wealthface offer you a variety of order types to trade:

- ● Market Order

- ● Limit Order

- ● Stop Order

-

What is a market order?

A market Market orders let you buy or sell a stock immediately at the best available price at the time of submission.

Only if the market is open, can you execute a market order. You can submit an order for execution right the way and fill at the best available price contingent on the liquidity at each price level.

Note if the order is not filled or cancelled, the order will expire at market close.

Please note Our executing brokers are obligated by law to give you the best available price based on the National Best Bid and Offer (NBBO).

An example: It’s important to note that market orders do not guarantee a price of execution, anyhow it is executed as quickly as possible on the market at the best available market price.

-

What is a Limit order?

A market order is a type of order that investors do not want to execute to trade the share at the market price. Investors want to buy the share at a lower price than what is correctly in the market. This is called a limit buy order or investors want to sell the share at a higher price of what is in the market this is called a limit sell order.

-

What is a Stop order?

A stop order or stop limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specific price.

A stop order is to buy or sell a stock when the share price moves to a certain limit price. Investors who do not want to execute the trade on the market price put a stop order to limit their loss or protect gains when they want to sell shares that they hold in their portfolio.

An example stop limit buy:

Apple is currently trading at $145 but you think it’s going to increase, and you want to buy once the price starts moving upwards. You place a stop-limit buy order at $150 and a limit price at $155. If the price of Apple reaches $150, your order will convert to a limit order with a limit price of $155.

An example stops limit sell:

Apple is currently trading at $145 but you think it’s going to decrease, and you want to sell once the price starts moving downwards. You place a stop-limit sell order at $1135 and a limit price at $130. If the price of Apple reaches $135, your order will convert to a limit order with a limit price of $130.

-

Can you short sell a stock on Wealthface?

Wealthface does not support short selling.

-

Where can I see all my account activities and trades on Wealthface?

To view all your activities including the trades on your account. Follow the steps below:

- ● Navigate on your profile by clicking on the up right of the screen

To view all the trade orders on your account. Follow the steps below:

- ● Navigate on your profile by clicking on the up right of the screen

- ● Click Activity

- ● Select the period you would like to check all the activities

-

Where can I see all my account orders on Wealthface?

To view all the trade orders on your account. Follow the steps below:

- ● Navigate on your profile by clicking on the up right of the screen

- ● Click Activity

- ● Select the period you would like to check all the paced and executed orders

-

What is the difference between open and executed orders?

Open orders are orders which are still not executed on the market. You can cancel an order that is still not executed.

Executed orders are orders that have been filled on the market and that you can cancel.

-

How can I search for stocks?

You can buy search for a stock on Wealthface app by following the steps below:

- ● Click on the search bar

- ● Choose the stock that you like by entering the name or the symbol

- ● Click on the stock tab to open the stock page

-

How can I add stocks to my watchlist?

You can add a stock on Wealthface app by following the steps below:

- ● Click on the stock tab to open the stock page

- ● Add the stock to a new or existing watchlist

- ● Click on confirm

-

How can I create a watchlist?

You can create a watchlist on Wealthface app by following the steps below:

- ● Go to watchlist section on the app

- ● Click on create a watchlist

- ● Search for the stock and add it to the watchlist

- ● Add the stocks that you like to add them on the watchlist

- ● Click on the confirm button

-

How do I buy stock?

In order to buy stock on Wealthface app by following the steps below:

- ● Click on the search bar

- ● Choose the stock that you like by entering the name or the symbol

- ● Click on the stock tab to open the stock page

- ● Click on the buy button

- ● Enter the cash amount or the number of shares

- ● Click on review the order

- ● Click on place the order

-

How do I sell a stock?

In order to sell a stock on Wealthface app by following the steps below:

- ● Go to your dashboard section on the app

- ● Choose the stock that you like to sell from your portfolio

- ● Click on the logo button of the stock

- ● Click on the sell button

- ● Enter the cash amount or the number of shares

- ● Click on sell all if you want to sell all your stock position

- ● Click on review the order

- ● Click on place the order

-

How can I build a basket/portfolio?

In order to create a basket/portfolio on Wealthface app by following the steps below:

- Go to your basket on the app

- Click the create basket button and name it

- Search for the stock and add it to the basket

- Choose the amount or the weight of each stock

- Select the number of stocks that you like to add them on the basket

- Click on the confirm button