How to Use the 50/30/20 Rule to Manage Your Finances

When you receive your monthly salary, hopefully you spend some time making a budget to govern all your expenditures. It’s very important to be aware of the inflow and outflow of money in your life.

It’s incredibly important for you to review your spending and create a budget. Once you’ve reviewed your spending and created a budget, you will be in a position to recognize exactly what proportion you spend on your home, your car, discretionary spending, and how much you divert to your retirement accounts.

That’s all good, but make sure you’ve also thought about how to allocate your savings for things such as an emergency fund for unforeseen circumstances. Financial advisors from Wealthface can help you with building an emergency fund. Ask yourself this question: Does my current financial allocation compare favourably with the amount I should ideally spend and save?

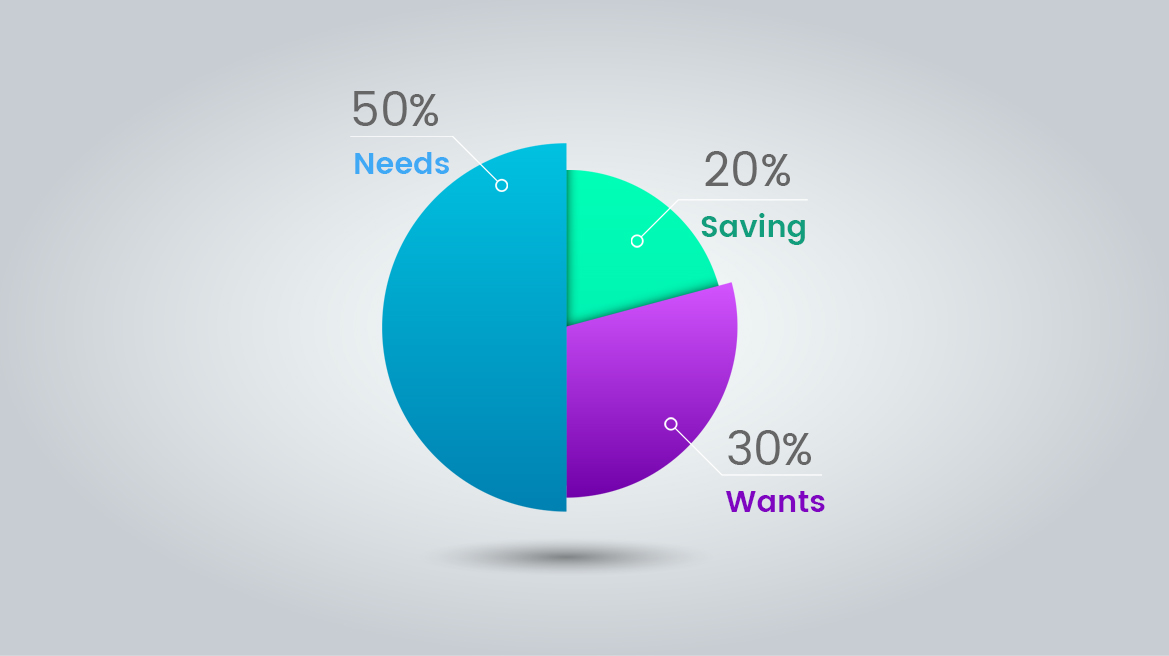

The 50/30/20 rule can be extremely helpful for you if you want to allocate your funds wisely and judiciously.

Harvard bankruptcy expert Elizabeth Warren, who also happens to be the U.S. Senator from Massachusetts and named by TIME magazine as one of the 100 Most Influential People in the World in 2010, coined the “50/30/20 rule” for spending and saving with her daughter, Amelia Warren Tyagi.

They co-authored a book called “All Your Worth: The Ultimate Lifetime Money Plan” in the year 2005.

So if you are wondering how the 50/30/20 rule works, this post will give all the answers to you. Let’s take a look at the four steps of Warren and Tyagi’s recommended way of organizing your budget:

Calculate your after-tax Income

Your after-tax income is what remains of your paycheck after taxes are taken out, such as state tax, local tax, income tax, Medicare, and Social Security. If you’re an employee with a steady paycheck, your after-tax income should be easy to figure out if you just look at your paychecks. If health care, retirement contributions, or any other deductions are taken out of your paycheck, add them back in.

If you’re self-employed, your after-tax income equals your gross income minus your business expenses, such as your office maintenance charges, laptop or airfare to conferences, as well as the amount you set aside for taxes. You’re responsible for remitting your own quarterly estimated tax payments to the government because you don’t have an employer to take care of it for you.

Just remember that being self-employed means that you want to also pay the self-employment tax, so ensure that you include this in your calculations. The self-employment tax is double of what you would pay in Medicare and Social Security taxes if you were employed.

Now go back to your budget, and figure out how much you spend on “needs” each month. Needs can include things such as groceries, housing, utilities, insurance, car payments, and automobile insurance. These are things you have to spend your money on. It’s not possible to skip spending money on needs. According to Warren and Tyagi and their 50/30/20 rule, the quantity that you simply spend on this stuff should not exceed over 50% of your after-tax pay.

Of course, now you must differentiate between which expenses are “needs” and which are “wants.” Basically, any payment that you simply can forgo with only minor inconveniences qualifies as a “want”. Things like dropping a streaming service subscription or not purchasing back to school clothing, fall into such a category. Any payment that might severely impact your quality of life, like electricity and prescription medicines, is a need and can not be clubbed with wants.

If you can not forgo a payment like a minimum payment on a mastercard, it can be considered a “need,” because your credit score will be negatively impacted if you don’t pay the minimum. Going by the same principle, if the minimum payment required is $25 and you often pay $100 a month to maintain a manageable balance, that additional $75 isn’t a requirement and you can stop spending that extra $75.

This sounds great on the surface. If you decide to put 30% of your money toward your wants, you’ll be fantasizing about beautiful shoes, a visit to Tuscany, spa days, and dinners at sushi restaurants.

Hold on to your horses for a moment there. Your “wants” don’t include extravagances. They include the basic niceties of life that you enjoy, like your phone’s data and calling plans, your home’s cable bill, and essential repairs to your car.

If you introspect a little, you will realize that you are spending far more on your ‘wants’ than you might think. A threadbare minimum of warm clothing may be a need during the winter. Anything beyond that, like buying clothes at a high end store in a mall,instead of at a reduction outlet, qualifies as a want. The rules might seem a little tricky on the surface, but if you spend some time mulling over them, they make absolute sense.

Remember the extra $75 you paid for your credit card that we talked about a few hundred words ago? Let’s discuss a little more about that. That’s neither a want nor a need. It’s the “20” in the 50/30/20 rule. It’s in a class all its own.

You should spend at least 20% of your after-tax income repaying debts and saving money in your emergency fund and your retirement accounts. If you use a credit card regularly, the minimum payment associated with the card counts as a “need” and it counts towards the 50%. Anything extra is a further debt repayment, which falls inside this 20% category. If you carry a mortgage or an automobile loan, the minimum payment is a “need” and any extra payments count toward “savings and debt repayment.”

Let’s assume that your monthly wage is $4,000. Using the 50/30/20 rule, you should be spending a maximum of $2,000 on your needs per month. You probably can’t afford a $1,500-a-month rent or mortgage payment, at least not unless your utilities, car payment, minimum credit card payments, insurance premiums, and other necessities of life don’t exceed $250 a month.

Your goal is to have the ability to fit of these expenses into 50% of your take-home after-tax income.

You can spend $1,200 a month on your “wants” based on that $4,000 you’re bringing home every month. You might have to consider doing without the few things that can be deemed expendable. You can also transfer some money to your “needs” section in case you are coming up short in that area. It doesn’t necessarily have to be a permanent change. But it must be done until you can get your needs down to a more manageable level. Remember, you will continue to have 20% left over so you’ll save and pay down your debts in a manner which is consistent with the 50/30/20 plan.

Now you have $800 left, that will serve as the last 20% of the 50/30/20 rule. Use that amount to pay your debts off, build an emergency fund, and plan for your future wealth building.