Critical Facts You Should Never Miss About Halal Investment

Investors usually purchase a company’s stocks for low value due to their expectations to go up in value in the short or long term. If such a thing happens, the value of the company’s stock increases. Which will be followed by selling the stock for a profit.

What is a Stock?

A stock is a term used to describe the ownership certificates of any company. When it comes to companies, issuing stock is the primary way to raise money to grow and invest in their business. For investors, stocks are a way to increase their cash and outpace inflation over time.

When you purchase stocks in a company, you are called a shareholder, for your share in the company’s profits.

Public companies tend to sell their stock through a Stock market exchange, like the Nasdaq or the New York Stock Exchange. The main factor that definitely affects the stocks’ prices, whether it is up or down, is supply and demand, which is constantly being tracked by the stock exchange

Anyone wishing to invest in buying stocks must consider the constant change in price movements and the daily fluctuations. Then it is up for the investor to decide whether he wants to sell and buy others or forget about them for a while so that they hope that their prices will rise dramatically in the long term. But this is not always the case, as it may happen precisely the opposite of what was expected so that the share prices fall and the investor loses part or all of his money. For this reason, stock investors need to distribute their purchase of shares among several companies instead of focusing on one company.

How to Seize Stocks to Make Money.

Perhaps the risks involved in stock investments are much more significant than others; however, the profits and returns that accrue to their owner are undoubtedly more effective than the returns on other investments. Investors make their money by investing in stocks in two ways:

- Selling the stocks when their prices go up during the time they own it.

- Hold your positions for a minimum of five years with solid financial companies. For example, retired IRS agent Anne Schreiber built her $22 million portfolios by investing $5,000 over 50 years.

Keys You Must know about Stocks

- There are two types of stocks: common and preferred stocks. You are likely to want to invest in common stocks if you are new to investing in stocks and looking to buy new shares. Owners of common stock may earn dividends; however, it is not guaranteed. On the other hand, dividends are paid to prefer shareholders in a fixed term. But still, preferred stocks are less prone to gaining value.

- Investing in individual stocks takes time. Reaching every stock you purchase and research into the bones of the company and its financials would take some time and be exhausting.

- Long-term Invest fits your goals the best: owning a diversified portfolio including many stocks and holding on to them through good times and bad.

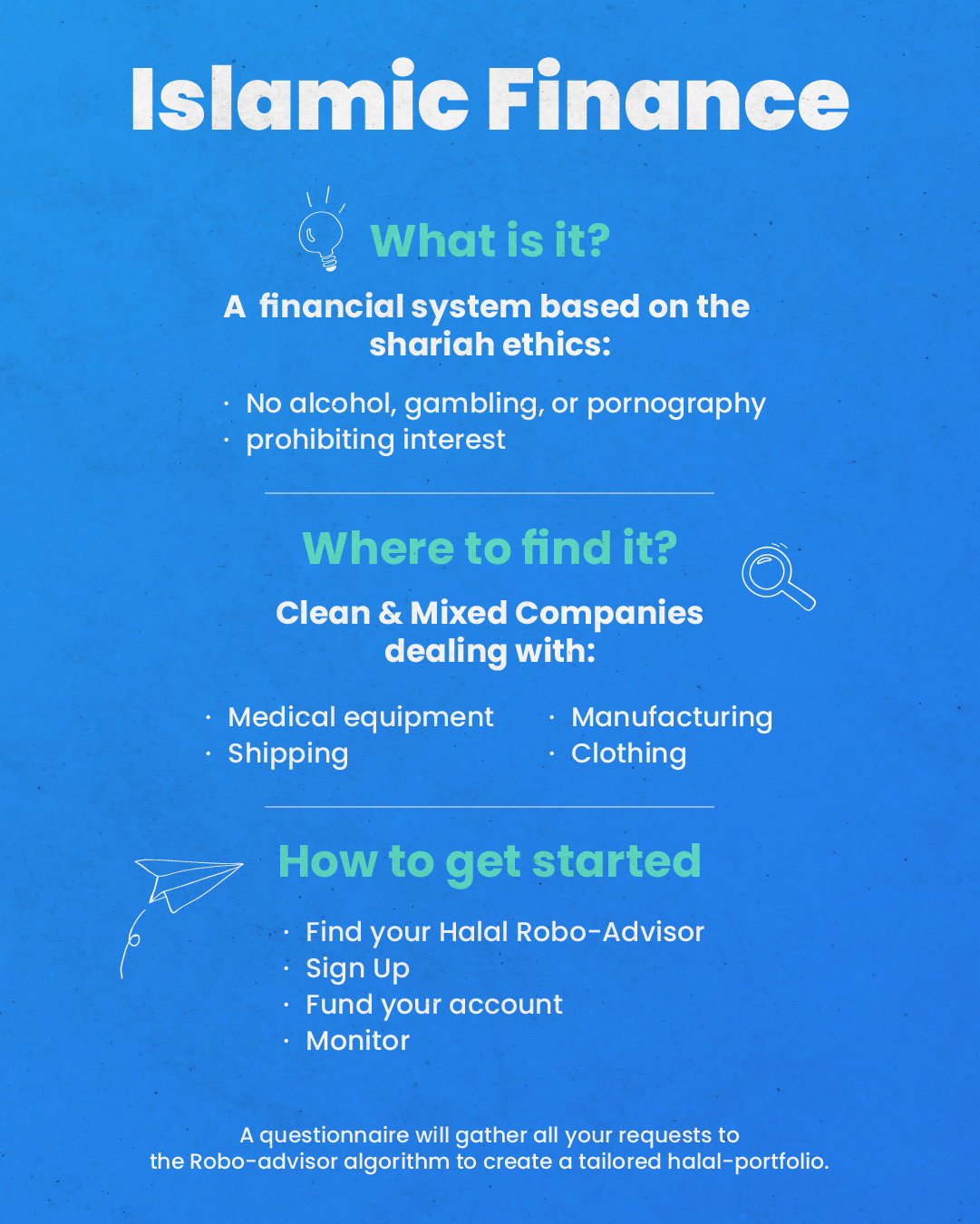

Halal Investment: Stocks and The Islamic Shariah

The words halal and haram are the most common terms used in the Islamic shariah to designate allowed and forbidden acts. These two concepts do not stop at the contents of daily life but apply to individual and collective business and commercial practices, random or organized, temporary or permanent alike. Issuing Shares Is Halal, Right?

Buying a stock means owning a percentage of shares in a particular company. Accordingly, it is accepted that buying stocks is not Haram. However, you need to ensure that the company is not dealing with in-Islamic manners. Companies like Samuel Smith’s Imperial Stout (alcohol) and Ladbrokes (gambling), for example, would not be permitted

Accordingly, companies can be broken down into 3 categories based upon the Islamic perspective.

- Clean companies that issue Shares from Halal practices. Shipping, manufacturing, clothing, medical equipment, real estate, tools, furniture, supplies, and so on are all acceptable practices that are free from the basis of Riba (unjustified lending.

- Companies that deal with Shares based on prohibited or Haram practices. These practices include alcohol, hotels, nightclubs, pornographic materials, riba-based banks, commercial insurance companies, etc., accordingly issuing shares with these kinds of companies if prohibited and not allowed by the Islamic Shariah.

- Mixed companies that issue Shares based on partly haram practices. Some practices seem to be Haram, and still, you find it well-traded and vigorous, while the majority of the work may be permissible.

What to Do With All These Options?

Obviously, the first and the third areas (clean and mixed companies) are the best choices for you if you are looking for a common ground that combines your ethics and investment ambition. On the other hand, most scholars agree you simply need to avoid companies where the considerable value of their stocks is derived from Haram practices.

Avoid heavily leveraged companies concerned with issuing haram goods and services. So, overall, whether stock trading is permissible or impermissible entirely depends on the companies you opt for and how much profit you retain.

How to Start Halal Investment With Wealthface Platform

So, you’ve finally decided to start investing. However, as you know the market, there are hundreds of stocks waiting for you out there to choose from. How are you planning to know the few worth buying with this vast number of stocks? Due to it is almost impossible to cover every single stock, and to make it easier for you, Wealthface (the best Robo-advisor platform in UAE) has carefully chosen more than 50 companies and investments aligned with the Islamic Shariah (check our website to know more about us.

But before you sign to build your portfolio, you need to make sure:

- To stay aware of the daily news, trends, and events that drive the economy and every company.

- To decide in advance, what are your portfolio’s goals.

Your account with Wealthface will allow you to access the most advanced tool with our factor investment feature. This feature will allow you to enter the world of halal investments by clicking on the halal property, which in turn will study your interests and analyze them to give you the most essential shares that you can buy and sell. Accordingly, you can gather these stocks in a portfolio with rebalancing features, or even you can trade them by yourself if you believe you have excellent experience in the domain.

Here are some qualities you’ll enjoy the moment you own your portfolio:

- Free investing learning resources.

- Nonadditional fees for Halal Investment portfolio.

- Affordable fees that are competitive with the market.

However, you have to keep in mind that you won’t benefit from the diversification feature if you chose the halal investment platform.