Is It The Right Time To Rebalance?

The purchase of assets and allocating them in a portfolio is based on reassuring the level of risk that the investor wanted from the beginning alongside the return characteristics. So to maintain the actual rates of risk characteristics over time, the portfolio must be rebalanced periodically.

In other words, the best way to restore the portfolio to its target allocation is through Rebalancing.

Can’t It Be Done Without Rebalancing?

Establishing better risk control, alongside freeing the portfolio from relying on a specific stock on the success or failure of a particular investment, are the primary objectives of portfolio rebalancing.

For example, let’s assume that you distributed the value of your portfolio in investing with two funds, A&B, equally. 5000 $ were infused with mutual fund A, and 5000 $ were invested in mutual fund B.

While portfolio A was periodically rebalanced and maintained chosen benchmark performance, portfolio B was not checked by portfolio managers, which could cause an unexpected downturn and change of carried risk.

By a year from now, your investment of 5k $ within fund A will be doubled or even tripled and turned into a dividend of -let say- 15k $. While fund B will be Probably lose a great deal of its value.

Both funds won’t perform equally due to the market forces over stocks, besides the law of supply and demand. So while fund A returns earnings up to 15k $, fund B returns with 10k or even loses part of its value.

Portfolio rebalancing must be carried out periodically to preserve the profit rates included in the portfolio and avoid risking a higher rate than planned. So if the coming year performed poorly, you would be safe from its repercussions.

As an Investor, How to Make Use of Rebalancing?

Rebalancing works as a risk-minimizing strategy for you as an investor alongside being a great strategy to enhance the performance and the growth of investor’s capitals . It allows you to align your investment with your short and long-term goals by periodically rebalancing your portfolio.

If your risk-investment strategy changes, you can rebalance the weight of the asset class in your portfolio by reassessing and devising a new asset allocation.

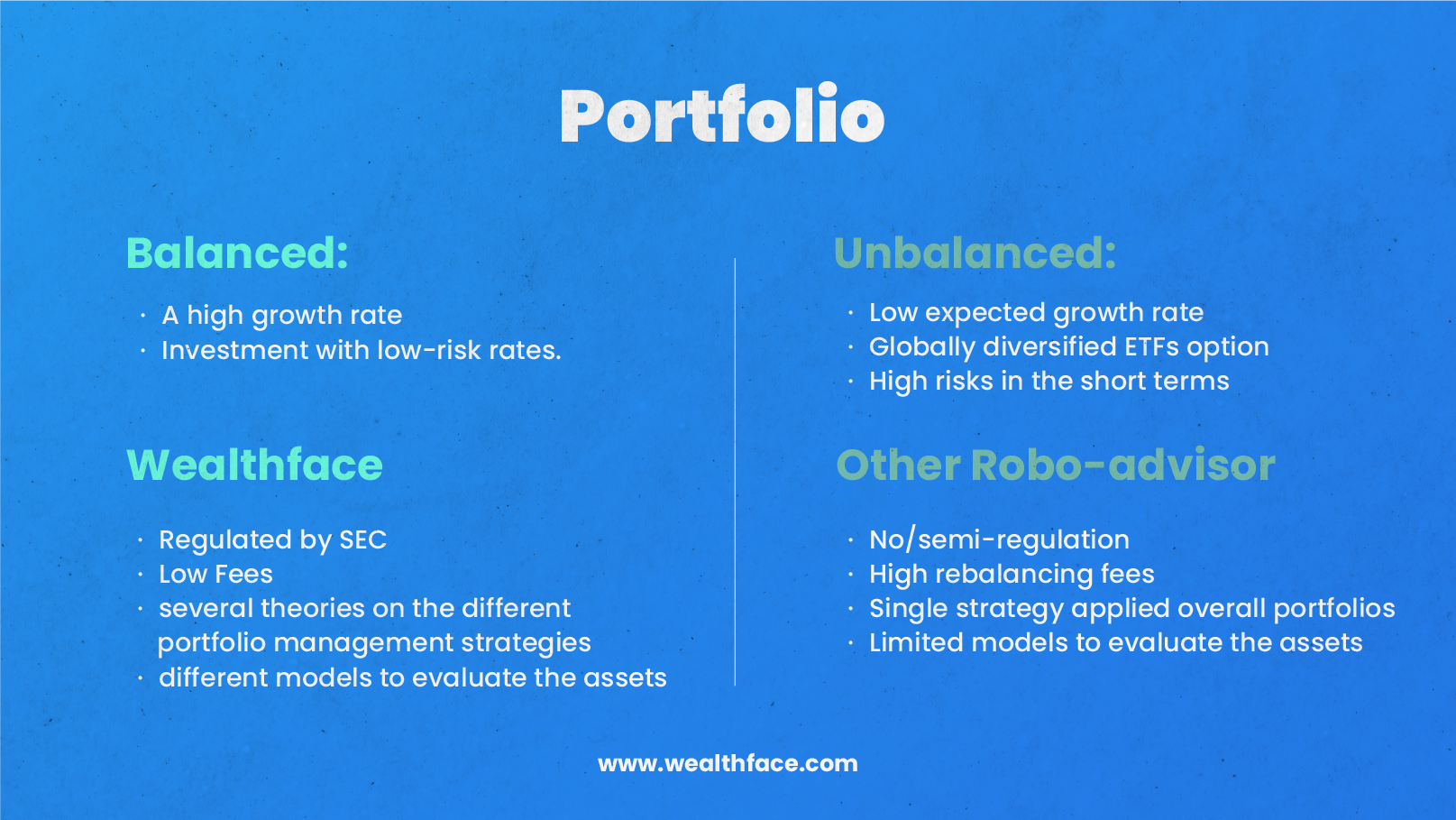

Wealthface’s Offer For You.

Investing in funds aims to achieve one goal through different vehicles over a certain period. Therefore, Rebalancing is a must for all the funds simultaneously. And to do that perfectly, years of experience are demanded.

Luckily, Wealthface has everything in place to do all of this for you and make things as easy as you need them to be. Here the uniqueness of investor’s styles is appreciated and valued. Your portfolio will be rebalanced regularly by experts in a way that aligns with your investing character, and guess what?

You won’t be entitled to any extra fees for doing that. Wealthface believes that portfolio rebalancing should be something that occurs regularly throughout an investor’s life – it should evolve, as investors do, and grow with their changing needs.

Sometimes, it needs to happen to make sure your original goals are still being catered for.