Halal Investment Ideas for 2021

- Buy any stock with $1

- Access AI Analysis

- Monitor stock scoring

- Select portfolio strategies

- Access real market price

Muslim investors are highly faithful towards their religious principles on financial practices.

It has accelerated the growth of a niche market for shariah-compliant products and halal investments.

Ensuring that their earnings are Halal is very crucial.

People regularly ask us about halal investment ideas.

Hence, we are mapping out some interesting places to invest in for 2021.

Even if you already are an astute investor, you may find something riveting out here which you hadn’t thought of.

What is Halal Investing?

Halal investments, also known as shariah-compliant investments, refers to investments in those products which comply with the principles of Islamic law.

In modern parlance, Halal investments are socially responsible investments.

It is because the doctrines of Shariah ask the investors to protect and preserve five key areas, i.e., religion, life, intellect, family, and property.

It is to build a balanced ecosystem between society and the individual.

The three essential principles laying the foundation of Shariah-compliant or Halal investing are:

- Transactions cannot involve Riba, i.e., gaining interest from loans or deposits, even if charged at par with the market rates

- Investment in “haram” industries is strictly prohibited.

Halal = permissible, and Haram = NOT permissible

Some examples of what Shariah law would prohibit, include:

- Interest or speculation

- Anything involving alcohol, pork, or meat products that are not slaughtered in an Islamic way

- Gambling

- Production of weapons of mass destruction

- Pornography

- Cloning

- No investments are made in activities related to gharar (uncertainty) or maysir (gambling).

Halal investments work around 3 Golden Rules

- Know why you’re investing – Profile your risk appetite to make reasonable investments as it directly correlates to the returns that you would be generating.

- Treat time to be your best friend – Try to understand the perfect time for entering and exiting from the market to make the best return out of your cash outflow.

- Diversify your portfolio to protect yourself from the downside in the market.

What are some of the Halal Investment options?

1- Stocks – publicly traded shares of companies

It is the best form of long-term investing which comes with a wide range of choices. Investors have to ensure that these stocks are Shariah-compliant by checking the following:

- Only common stocks are Shariah-compliant. Any other kind of shares is non-compliant.

- Non-compliant activities of the business must form less than 5% of the total income of that company.

- Company debts, cash, and receivables must have some restrictions.

However, an investor must always ensure that these are high – risky investments as their prices can fluctuate significantly.

Listed below are several Shariah-compliant stocks. It is not an entire list, but some of the large blue-chip companies that are traded publicly.

- Dupont

- Pfizer

- Pembina

- Abbott Labs

- Chevron Corp.

- Canon

- Novartis

- Intel Corp

- Exxon Mobil

- Saputo Inc

- Adobe Inc.

- Johnson & Johnson

- Rio Tinto

- Salesforce

- Merck & Co.

- Sanofi

- Prologis Inc.

and many more.

Business Ownership

It is yet another risky type of investment option amongst Muslims and therefore, less common.

However, the potential returns are very high as one can exercise direct control over their business.

The business owners must make sure that their activities don’t fall under the non-compliant list.

Real Estate/Property

It is the most highly desired type of investments for Muslims. It is a beneficial asset with around 6-10% stable return per annum.

One can also benefit from renting and hedging activities and enjoy income tax advantages.

Investors must make sure that the property is not utilized as an interest-based mortgage or for non-Shariah-compliant commercial activities.

This investment comes with limited liquidity. Therefore, an inspection is ideal before investing.

Land

The central idea for such an investment is to purchase strategic land and sell it for a profit. The amount is accumulated through crowdfunding.

Cash

A highly liquid and immediately available form of investment.

Though this isn’t giving any positive returns, it is generally held in huge margins by those people who do not possess an idea as to how to use this cash profitably.

To comply with the Shariah law, an individual must ensure that the cash is held in an account that does not pay interest.

Gold

Considered as a traditional and physical store of safety when it comes to the overall economy, Muslims are highly fascinated by their investments made in gold.

Sukuk

It refers to a fixed-income product which provides steady returns rather than a crazy growth.

Start-ups/Small Businesses

This form of investment comes with a high-risk but also offers a high-reward if done well. It is advisable to go with the notion that the venture you invest in will probably fail.

But if you have big pockets to invest in multiple ones, and even if one becomes a hit, it will provide you with tremendous returns.

SWOT Analysis of the Islamic Banking System

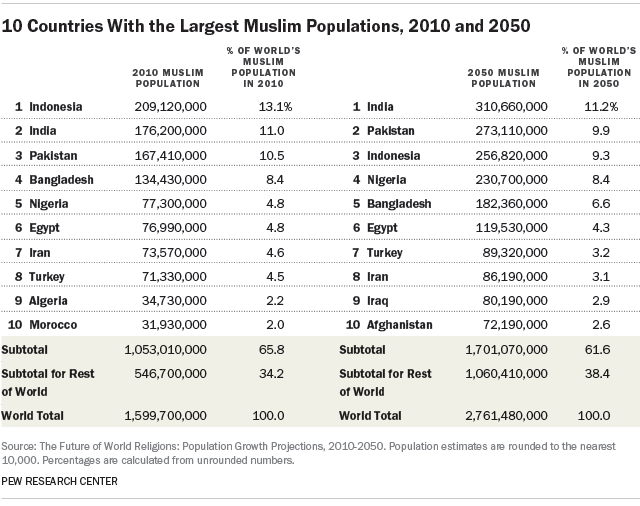

With a good population around the world being Muslims, the demand for such niche products, is rising steadily.

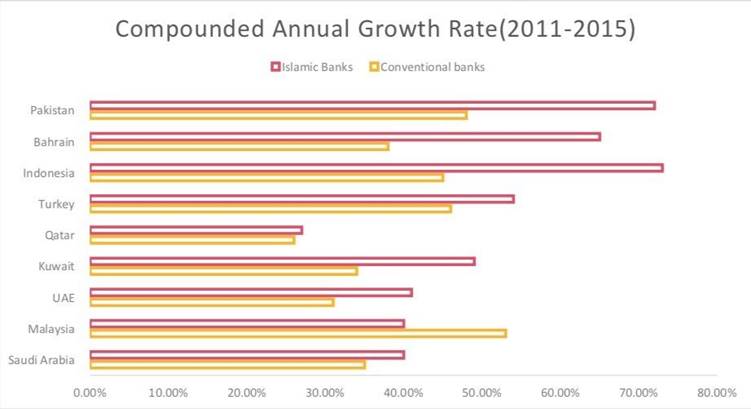

In the times of recession, these products are comparatively safer and have been proved better in the recent global financial crisis. It is a proven measure of financial inclusion.

Weakness: Majority of people believe that this system is for Muslims only, however, this is not the case. The lack of awareness about the same demands massive education needs to both the financial institutions and the users.

Opportunity: There is a large market for Islamic banking, and there are socio-economic developments taking place by of financial inclusion. It is an Asset-creation financial model.

Threat: This could become a political weapon. It is also difficult for this model to enter and grow in a market which is heavily dominated by conventional banks.

Wealthface, being a one-stop online investment company, caters to all kinds of investors.

It provides tailored, affordable and high-quality investment products and services in a fully transparent manner.

The company plays the role of a Fiduciary investment advisor by always putting its client’s interest as the priority.

Herein was mentioned some of the many halal investment ideas for 2021. Quickly filter and sort your options and find out what works for you.

Happy investing!