NFTs (Non-Fungible Tokens): All You Need to Know About

NFTs have provided some of the biggest financial stories of the last few years, and certainly some of the most eye-catching.

Whether it was Twitter co-founder Jack Dorsey selling his first ever tweet as an NFT for more than $2.9 million, or works of art fetching a record-breaking $69.3 million at auction, NFTs seemed to come from nowhere and instantly create their own speculative bubble.

Now, at the end of 2021, some of that initial hype has calmed down.

With NFTs no longer in the headlines, and prices more stable than they were, it might be time for serious investors to take another look at this asset class.

In this article, we’ll explain everything you need to know about NFTs – what they are, how they work, and (most importantly) whether you should invest in them.

What is an NFT?

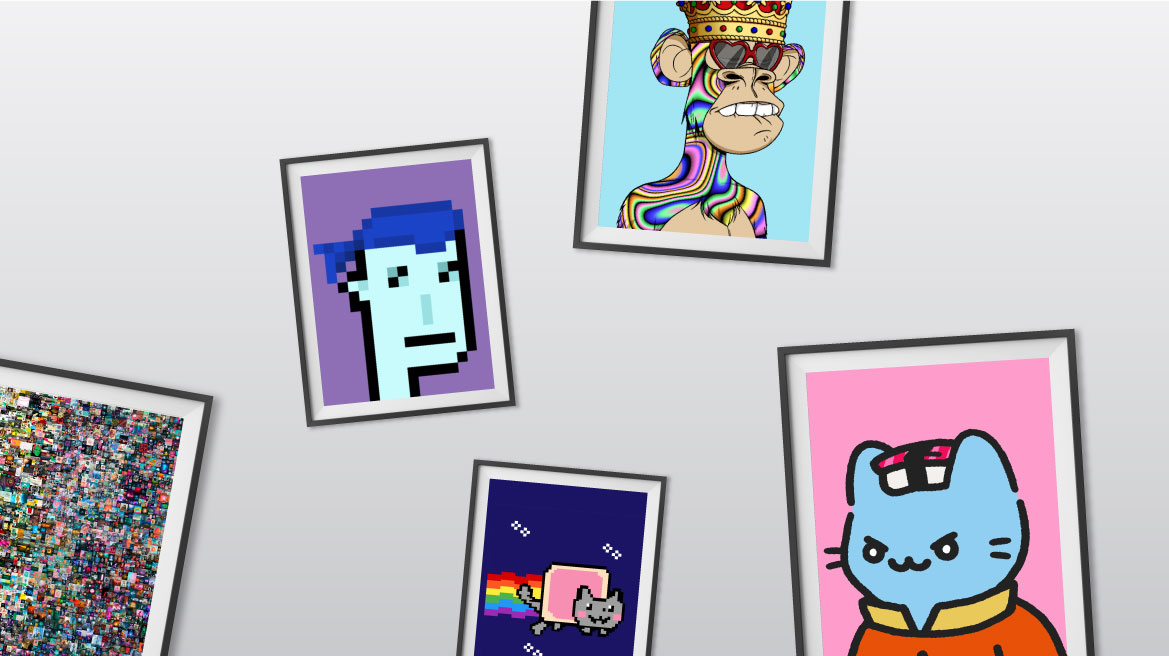

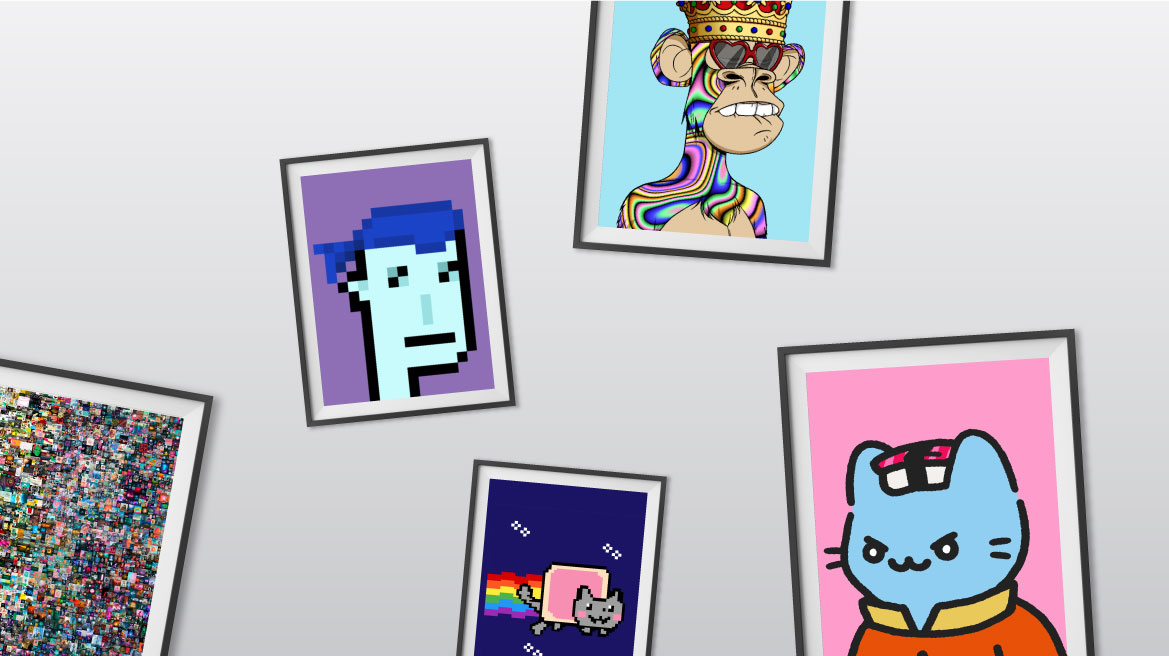

At the most basic level, an non-fungible token (NFT) is a digital asset that represents a real-world object.

These objects are generally digital themselves – videos, digital art, music, or items used in-game in video games.

An NFT is a way of proving ownership over an asset of this type, and that ownership can be worth a lot of money.

NFTs can be confusing, because the “objects” they are linked to are generally available for free online.

You don’t need an NFT to view the artworks that have recently sold for millions of dollars, for instance.

However, collectors are still willing to pay significant sums to own them, even if they can be copied and distributed for free.

Think of NFTs as a way of creating scarcity in a market for online art that is otherwise overrun with copies.

Because NFTs cannot be exchanged for each other (they are “non-fungible”, in the jargon) they can be used to uniquely specify the owner of an artwork.

Are NFTs Cryptocurrency?

NFTs are not cryptocurrency, though they are often associated with cryptocurrencies.

This is because the underlying technology behind NFTs is shared with cryptocurrencies like Bitcoin or Ethereum.

NFTs and these currencies use blockchain networks to create unique tokens, handle transactions, and verify the ownership of coins or tokens.

However, in other ways NFTs are fundamentally different from cryptocoins.

The major difference is apparent in the names given to the different types of token.

NFTs are, as their name suggests, “non-fungible”.

Bitcoins are inherently fungible, in that they can be exchanged for each other, and one Bitcoin will always be worth the same amount as another.

In contrast, NFTs each have a digital signature that make it impossible to exchange one for another.

This said, since NFTs and cryptocurrencies emerged from the same subculture, and since NFTs are often bought and sold with cryptocurrency, the two technologies have become closely associated in the popular imagination.

How Does an NFT Work?

Like cryptocurrencies, NFTs are created and managed through a blockchain.

This is a distributed network for keeping track of the ownership of a particular token – instead of a central database that lists the owners of NFTs and other tokens, in a blockchain this information is held and managed by all of the computers connected to the network.

Any blockchain can be used to create, manage, and administer NFTs, but in practice the Ethereum network is by far the most commonly used, and most NFTs are held ultimately on this network.

The process of creating an NFT generally starts with a digital object. These can be of any type, but the most common are:

• Art

• GIFs

• Videos and sports highlights

• Collectibles

• Virtual avatars and video game skins

• Designer sneakers

• Music

Any of these “objects” can be used to create an NFT, and once created the NFT can be shared via the blockchain.

This ensures that any NFT can only have one owner at a time, and that every computer on the network knows who this is.

Essentially, NFTs act as collectors items. People who collect limited-edition sneakers are unlikely to ever wear these shoes – what matters is that they are rare.

Since NFTs are each totally unique, they are a way of creating a scarce commodity in a digital world where it is otherwise easy to make free copies of almost anything.

How to Buy NFTs

The process of buying NFTs is straightforward, but you will need to acquire a few key tools before you can do so.

First, you’ll need a digital wallet that allows you to store NFTs.

Then, you’ll (most likely) need to purchase some cryptocurrency, because most NFTs are sold in this way.

The quickest and easiest way to do that is to use one of the popular exchanges such as Coinbase, Kraken, eToro, or even PayPal and Robinhood, where you can buy cryptocurrency with your credit card.

You can then head over to an NFT marketplace. The largest of these at the moment are open sea.io, rarible, and foundation.

All three of these marketplaces allow artists to offer NFT-enabled artworks to collectors, and so all three have thousands of NFTs available for purchase.

Should I Buy NFTs?

The most important question of all is, of course, whether NFTs are a good investment.

Given the amounts of money that some NFTs are sold for, it can be tempting to think that they are a great investment.

For the majority of investors, that will not be the case. The NFT marketplace is highly volatile, and with such a new asset class we have little data to base predictions of future performance on.

That said, approach NFTs just like you would any investment: Do your research, understand the risks—including that you might lose all of your investing dollars—and if you decide to take the plunge, proceed with a healthy dose of caution.