Why Is Portfolio Diversification Important?

For new investors, there is something very important to keep in mind: no one can predict the future, not even the top experts in any particular field.

No matter how sound a specific trade may seem at the time, there will always be external factors that can cause things to go haywire in the market.

Politics, culture, newsworthy events, and environmental factors all play a part in shaping the state of the stock market on any given day.

It may seem like bad news when you watch some of your stocks going down in value, but this is in fact a natural part of the ebb and flow of investing in the market.

So how can you protect yourself against high levels of risk in your investments- while also maximizing your profit margins in the long run?

Here’s a hint: don’t put all your eggs in one basket. Instead, diversify your portfolio.

Wealthface – Online Trading Platform Can Help You Create A Diversified Portfolio. Start Now.

In this article, we will take a look at what diversification is and how to start diversifying your portfolio now.

What is Diversification?

To explain what diversification is, let’s imagine an example that is unrelated to the stock market.

Picture two gardens.

-One garden is full of all different kinds of herbs, flowers, vegetables, and trees.

-The other garden has only one kind of plant, but a large quantity of that plant species. Everything is going well in both gardens and all the plants are growing happily.

Now imagine what happens when there is a sudden, unexpected infestation of a certain type of insect.

This insect just so happens to wreak huge damages on the plant that is planted in your second garden.

So the first gardens weathers the insect storm and suffers some damages, but recovers easily.

The second garden, that had only one type of plant in it?

That garden is destroyed.

The first garden is your diversified portfolio.

By allocating assets in many different types of investments, you will be able to minimize your risks and protect your capital from any unexpected events in the market.

If, on the other hand, you have invested all your capital in just one asset, then that asset is at high risk to the effects of an unexpected circumstance, like the insect infestation in the second garden.

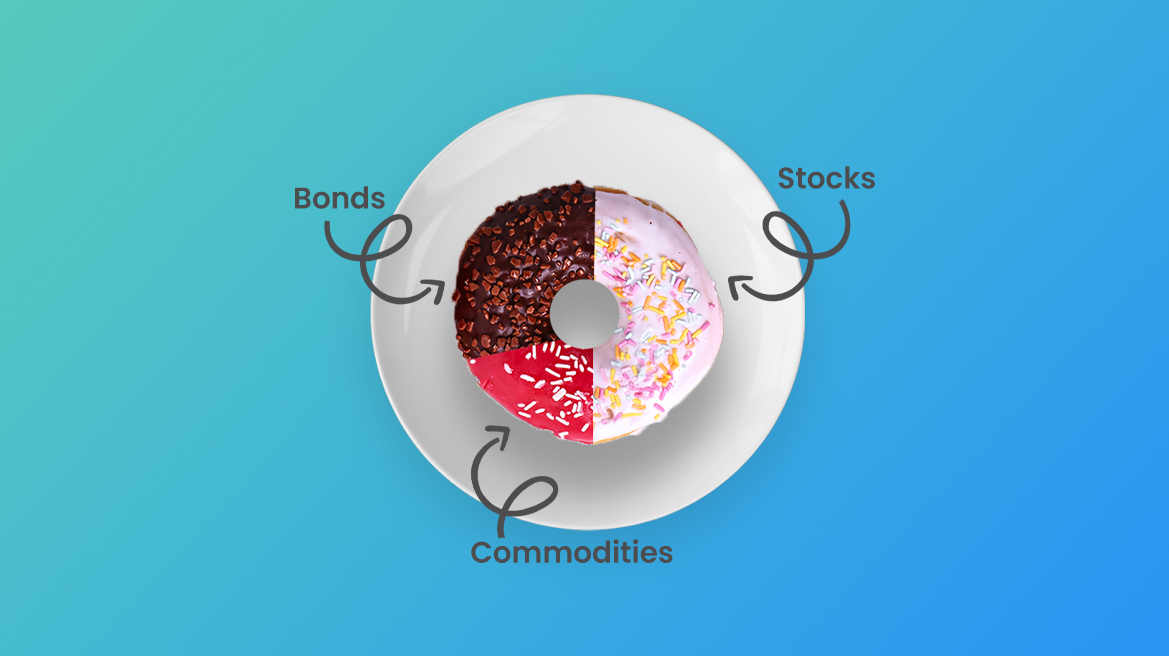

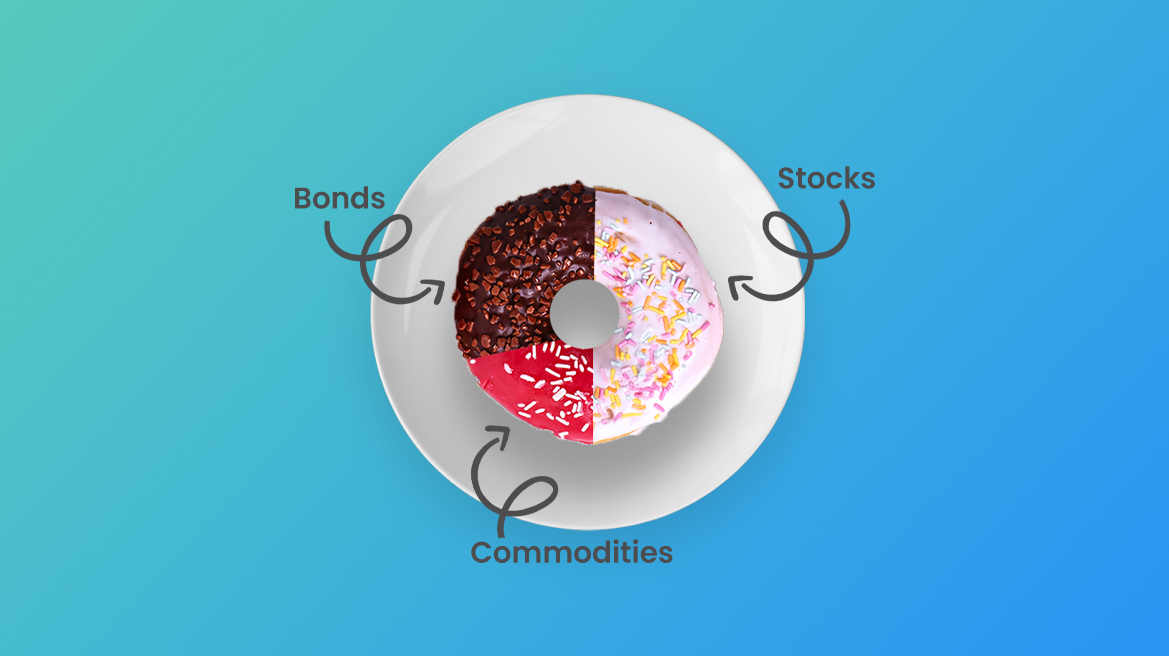

Just like the first garden example, you want to have a portfolio full of many different types of assets, each of which will respond differently to the same market event.

In a growing economy, for example, your stocks will likely outperform your bonds.

But when the market starts to slow down, your bonds may perform much better than your stocks. So over the long term, a diverse portfolio will balance your risks and profits.

The Benefits of Diversifying Your Portfolio

As we have mentioned above, diversifying your portfolio helps to protect your assets against the unexpected.

This strategy offers other benefits as well.

Diversifying your portfolio will help you to achieve your long term investment goals.

By readjusting your personal relationships or emotional attachments to any particular asset, you will be giving yourself more objectivity that will pay off in the long run.

Diversification keeps your portfolio healthy and provides more opportunity for long term gains.

With a diverse portfolio, you will avoid the damages of large losses, and will benefit from larger gains over time.

It is highly unlikely that all of your investments at any given time will be in decline.

Instead, while some assets may suffer strong declines, others will continue to grow, thus keeping your overall portfolio balanced.

So keeping a diverse portfolio minimizes the volatile ups and downs that can come with single asset investments.

The benefits of diversification include:

- Minimizing the risk factor for your entire portfolio

- Presenting more opportunities for profitable returns

- Keeping you safe from unfavorable market conditions

- Protecting your portfolio against unexpected market and economic events

- Reducing your portfolio’s overall volatility

Must Read: What is the purpose of a diversified portfolio?

How to Start Diversifying Now

If you are looking to diversify your portfolio now, you will be pleased to learn that it is actually a straightforward process.

Just download the free Wealthface app on your smartphone.

This valuable investing app offers a simple and easy to navigate platform that will save you tons of time and hassle.

Most notably, the Wealthface app offers an automatic rebalancing tool to help you maintain a healthy diversified portfolio.

You set the parameters of how much you would like to invest, which kinds of assets you are interested in investing in, and how long term you would like these investments to be.

Then, using sophisticated AI insights, the app’s automatic rebalancing tool will keep your portfolio effectively diversified.

You can track the progress and status of your individual assets as often as you like, while keeping an eye on the long term goals.

You can even store your returns in the app’s digital wallet.

Wealthface is an easy and effective way to ensure that your portfolio will be diversified and bring you the maximum returns.

Final Thoughts

As we have explored above, a diverse portfolio is a healthy portfolio.

Diversification can help minimize risks and volatility, expose you to more opportunities for returns, and keep you safe against unfavorable market conditions.

How can you tell if your portfolio is effectively diversified?

Look at your current performance- your investments should not all be going in the same directions. In fact quite the opposite.

Some of your assets will be declining in value while others continue to grow. This is the sign of a well-balanced portfolio that will maximize your long term benefits.