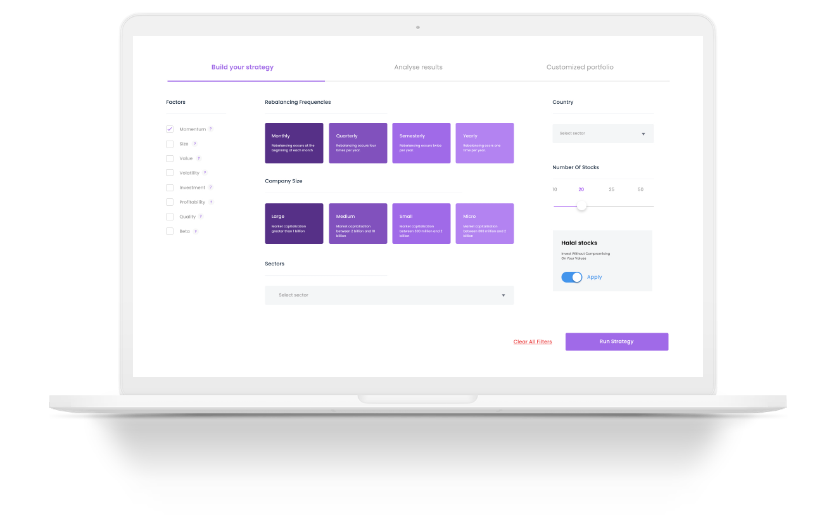

Start trading like a PRO

- Select one or multiple Factors

- Number of stocks

- Sectors of your choice

The size factor represents the relationship between the size of a company and its future performance. Through their academic research, Fama & French (1992) found that in the long term, a portfolio of smaller size companies is consistently outperforming a portfolio of larger size ones. We can identify small size stocks by their market capitalization.

The value factor represents the relationship between the company’s relative valuation, and it’s future performance. Through their academic research, Fama & French (1992) found that in the long term, a portfolio of relatively cheap companies is consistently outperforming a portfolio of relatively expensive ones. We can identify the cheapness of a company by a lower price to book ratio.

The momentum factor represents the relationship between the stock's past and future performances. Through their academic research, Jagadeesh & Titman (1993) found that in the long term, a portfolio of previous winners is consistently outperforming a portfolio of past losers. We can identify winners by calculating their past 12 month's performance and omitting the last month.

The volatility factor represents the relationship between the stock’s volatility and, it’s future performance. Through their academic research, Haugen & Heins (1972) found that in the long term, a portfolio of low volatility stocks is better in terms of risk adjusted-return than a portfolio of high volatility ones. We can identify low volatile stocks by their 1-year volatility.

The profitability factor represents the relationship between the company’s profitability, and it’s future performance. Through his academic research, Robert Novy-Marx (2013) found that in the long term, a portfolio of companies with higher profitability is consistently outperforming a portfolio of companies with lower profitability. We can identify highly profitable companies by their gross profit to assets ratio.

The investment factor represents the relationship between the company’s assets growth, and it’s future performance. Through their academic research, Sheridan & Wei (2004) found that in the long term, a portfolio of companies with lower asset growth is consistently outperforming a portfolio of companies with higher assets growth. We can identify lower investment companies by their 1-year asset growth.

The quality factor is an extension of the profitability factor. It represents the relationship between the company’s quality, and it’s future performance. Through their academic research, Hsu, Kalesnik and Kose (2019) found that in the long term, a portfolio of companies with higher quality is consistently outperforming a portfolio of companies with lower quality. Even though there is no consensus of how quality should be defined by academic researchers, the authors found that profitability ratios, accounting ratios, payout ratios and investment ratios are robust and significant in the long term. We define the quality factor by stocks with high return on equity, high payout ratio and low asset growth.

We cover our clients globally.

We are here for you wherever you are.

Wealthface is a global name you can depend on.

We are regulated by the SEC and the FSRA, we are located in 4 continents.

- Pay a maximum of $1 per transaction or per share.

- Start trading stocks for as little as $1.

- Benefit from multiple order types: market, limit, and stop.

- Receive live market data for stocks.

- Get access to our diverse themes list.

- Build and rebalance your own portfolio.

- Benefit from monthly admin fees as low as $2.

- Enjoy free local transfers if you’re in the UAE.

- Sell stocks for free.

- Pay per share for buy and sell orders.

- Start trading stocks for as little as $1.

- Benefit from multiple order types: market, limit, and stop.

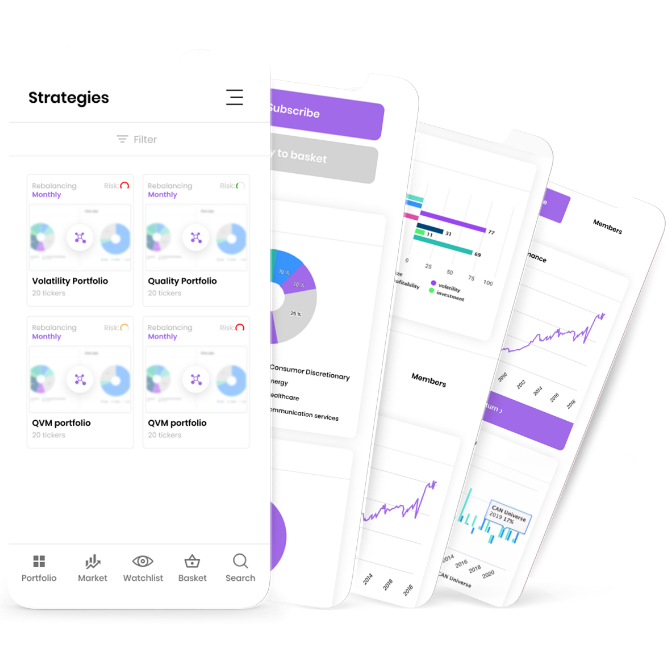

- Access our collection of quantitative investment strategies.

- Receive live market data for stocks.

- Get access to our diverse themes list.

- Build and rebalance your own portfolio.

- Access quantitative stocks analysis.

- Benefit from no monthly admin fees.

- Enjoy free local transfers if you’re in the UAE.

-

What is quantitative investing ?

Quantitative investing is a computer-based investment approach that uses mathematical models to screen and evaluate thousands of company stocks at the same time. The model looks at multiple financial or technical ratios, including risk levels, past performance, sectors or even countries to find the best companies.

-

What is factor investing?

Factor investing is a strategy or an investment approach that chooses securities based on attributes that are associated with higher returns.

There are two main types of factors:

Macroeconomic factors and Style factors.

Investing in factors can help improve portfolio outcomes, reduce volatility and enhance diversification.

-

How many factors are there ?

Academics have identified many different factors, but there are six equity factors that stand out in terms of academic robustness:

- Volatility

- Value

- Size

- Momentum

- Investment

- Profitability

-

What is the volatility factor ?

The volatility factor represents the relationship between the stock's volatility and its future performance. Through their academic research, Haugen & Heins (1972) found that in the long term, a portfolio of low volatility stocks is better in terms of risk-adjusted-return than a portfolio of high volatility ones. We can identify low volatile stocks by their 1-year volatility.

-

What is the value factor ?

The value factor represents the relationship between the company's relative valuation and its future performance. Through their academic research, Fama & French (1992) found that in the long term, a portfolio of relatively cheap companies is consistently outperforming a portfolio of relatively expensive ones. We can identify the cheapness of a company by a lower price to book ratio.

-

What is the size factor ?

The size factor represents the relationship between the size of a company and its future performance. Through their academic research, Fama & French (1992) found that in the long term, a portfolio of smaller size companies is consistently outperforming a portfolio of larger size ones. We can identify small size stocks by their market capitalization.

-

What is the momentum factor ?

The momentum factor represents the relationship between the stocks past performance and its future performance. Through their academic research, Jagadeesh & Titman (1993) found that in the long term, a portfolio of past winners is consistently outperforming a portfolio of past losers. We can identify winners by calculating their past 12 months performance and omitting the last month.

-

What is the investment factor ?

The investment factor represents the relationship between the company’s assets growth and its future performance. Through their academic research, Sheridan & Wei (2004) found that in the long term, a portfolio of companies with lower assets growth is consistently outperforming a portfolio of companies with higher assets growth. We can identify lower investment companies by their 1-year asset growth.

-

What is the profitability factor ?

The profitability factor represents the relationship between the company’s profitability and its future performance. Through his academic research, Robert Novy-Marx (2013) found that in the long term, a portfolio of companies with higher profitability is consistently outperforming a portfolio of companies with lower profitability. We can identify highly profitable companies by their gross profit to assets ratio.

-

Which factor is best ?

Academic research has shown that the six equity factors above all have the potential to outperform the broad market over the long term, but they may all have periods of short-term underperformance as well.That’s why diversifying factor exposures is the best solution for the long term investors.

-

Why do these factors exist ?

Factor exists due to three common reasons:

- Risk premium: Compensation for additional risks versus the broad market that is, for an undesirable return pattern.

- Behavioral psychology: Markets are inefficient due to behavioral characteristics of investors for example:

- Anchoring

- Action bias

- Loss Aversion

- Market structure: Markets can be inefficient due to restrictions and limitations, for example short selling or the use of leverage.

-

How can I benefit from factor investing ?

As an investor you can use factor investing in your portfolio to generate returns above the market, reduce your portfolio risk or improve your portfolio diversification.